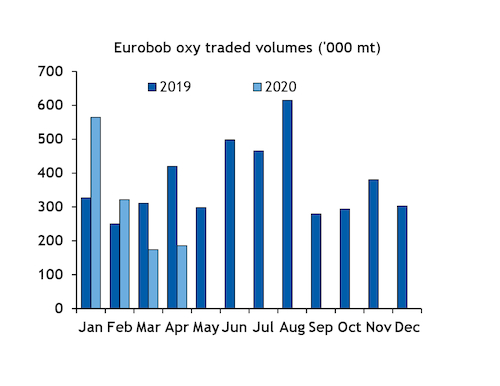

Argus Eurobob traded volumes reached a combined 186,000t in April, up from 174,000t in March but down from 311,000t a year earlier. Benchmark oxy volumes rebounded strongly, accounting for the vast majority of last month's total.

Oxy barge trading liquidity rose to 172,000t in April from 82,000t in March — when volumes dropped to their lowest on record, coinciding with the start of travel restrictions imposed in Europe to limit the spread of the Covid-19 pandemic.

The total is still down on the previous year, from 386,000t in April 2019. And oxy barge volumes are also lower for the year so far, at 906,100t for January-April, compared with 1.19mn t in the same period of 2019.

The drop highlights the impact of widespread travel restrictions, which have cut road fuel demand by as much as 40-50pc in Europe. April typically marks the start of the peak summer driving summer season in the northern hemisphere, when volumes would be expected to rise in line with demand.

Shell was the largest buyer of oxy gasoline, securing 36,000t of Eurobob oxy barges in April, up from 8,000t in March. Macquarie bought 34,000t, from nothing the previous month. Hartree bought 28,000t in April, from 23,000t in March.

The remaining volumes were purchased by BP, Equinor, Mabanaft, Neste, Petroineos, Trafigura, Varo and Vitol.

Gunvor was the largest seller, parting with 93,000t in April, up from 4,000t in March, and Total sold 46,000t, compared with 34,000t in March. BP, Finco, Glencore and Neste sold the remaining volumes.

Neste returned to the Argus Eurobob barge window for the first time since 2012.

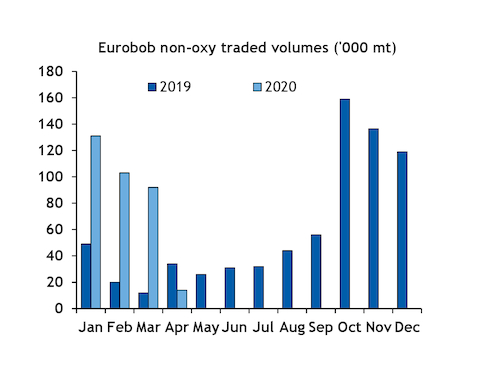

Trading liquidity on Argus Eurobob non-oxy gasoline barges fell to 14,000t in April, from 92,000t in March and 34,000t a year earlier. It is the lowest volume since Argus moved to a volume-weighted average non-oxy assessment in November 2019.

Non-oxy barge volumes are still sharply higher for the year to date at 341,000t for January-April, compared with 115,000t in the same period last year.

Varo secured 8,000t of non-oxy gasoline in April, from 60,000t in March. Mabanaft, Hartree and Equinor all purchased 2,000t each.

Finco sold 12,000t in April, from 16,000t in March. BP sold the remaining 2,000t of non-oxy volumes.