The contango structure in European and Asian curves may be steep enough to encourage multi-month floating LNG storage, which could limit US cancellations from August onwards.

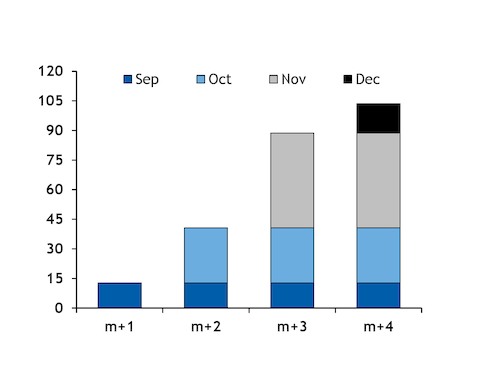

Time spreads in the main delivered markets may be wide enough to cover the additional costs to store LNG cargoes at sea for deliveries into the fourth quarter. The Dutch TTF August-November spread would be sufficient to cover additional shipping costs for up to approximately 89 days, based on Argus forward charter rates for tri-fuel diesel-electric (TFDE) vessels, boil-off of 0.1pc per day and average cargo size of 165,000m³. Similarly, the September-December spreads may cover additional shipping costs for up to 91 days.

The contango in the ANEA curve may not offer sufficient returns to delay deliveries of August cargoes, with only 52 days of additional costs potentially covered by the August-November spread. But November and December deliveries could offer sufficient returns for September-loaded cargoes.

Firms with available shipping capacity may have more flexibility to store cargoes. And more modern ships with lower boil-off rates also offer slightly higher flexibility, assuming charter rates for two-stroke vessels maintain the current premium to TFDE rates in the coming months.

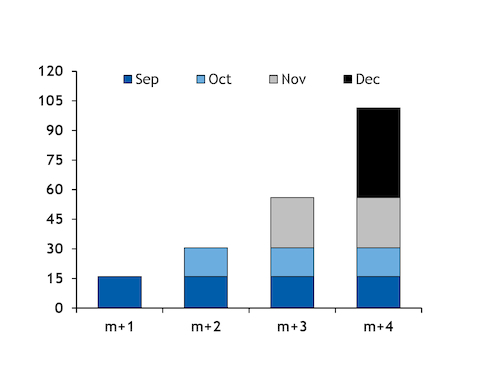

Floating storage opportunities may limit cancellations of US cargoes in the coming months, particularly for firms with a loading slot in the second half of the month, market participants said. But the TTF August contract remained below the corresponding Henry Hub price today, which may limit the time in which cargoes can be kept floating. A US offtaker paying 115pc of Henry Hub could keep an August cargo floating for up to 66 days before delivery into Europe in November, assuming a delivered price flat to the TTF. August cargoes from US producer Cheniere's facilities can be cancelled by 20 June.

Entering the winter with an ample number of cargoes already on the water and awaiting delivery may pose risks of delivered prices collapsing when approaching delivery, particularly in the event of a mild winter curbing demand, market participants said.

Spot demand in Asia-Pacific may also prove to be slower if firms with long-term contracts indexed to oil maximise deliveries when prices are lowest. Oil-linked prices with a six-month indexation period are lowest in November, with December prices also at a discount to October.