The oil price downturn and evolving energy transition strategies are pushing some of the majors to reduce and reshape their workforces.

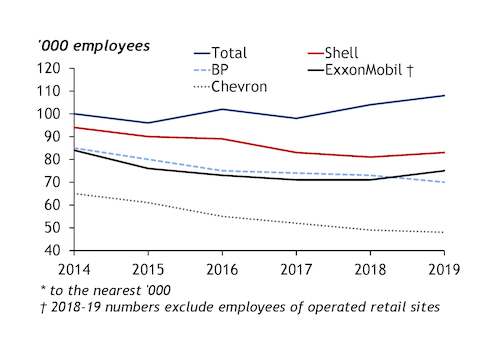

Planned job cuts of up to 15pc by Chevron and BP will winnow away workforces already cut by a similar proportion by the same firms, and by ExxonMobil, in the 2014-16 oil price downturn. But while all of the majors are reducing operating costs this year in response to sharply lower oil prices and Covid-19, their approaches are more nuanced when it comes to staffing. And while BP and Chevron's job cuts are similar in proportion, each is informed by a markedly different strategic outlook.

BP plans to reduce its global workforce by about 14pc, or 10,000, with the affected roles being office-based rather than in frontline operations. The cuts are part of chief executive Bernard Looney's structural reorganisation to make BP a lower-carbon and leaner company. But the oil price crash has "accelerated and amplified" its plans, the firm says. It costs about $22bn/yr to run BP, of which $8bn is "people cost", Looney says. The firm targets $2.5bn of operating cost reductions in 2021, and he says BP will likely have to deepen those cuts. A significant area for layoffs will be senior management, with wider cuts driven by the restructuring of the business into a form that BP says will be better suited to the energy transition.

Chevron plans to cut its global headcount by as much as 15pc, under similar pressures, but with what looks like a more short-cycle investment model in mind. The company says it is streamlining its organisational structures "to reflect the efficiencies and match projected activity levels". The job cuts are part of an operating cost reduction plan announced in March. Chevron had already cut its workforce by 13pc between 2016 and 2019, to about 48,000 (see table).

ExxonMobil plans to cut its operating expenses by 15pc, but chief executive Darren Woods says the company has "no layoff plans". As a short-term response to the "unprecedented demand drop from the pandemic", ExxonMobil stopped using oil service firms and contractors, he says. Thinking longer term, the firm continues to look into whether structural changes will be needed, Woods says.

Frozen two

Unlike the US majors, Shell and its European peers are under growing shareholder pressure to change their structures and speed up their alignment with the energy transition. But Shell alone has so far cut its dividend, partly in preparation for that shift, saving it $10bn this year and reducing the need for urgent redundancies. And its heavy divestment programme since its acquisition of UK firm BG in 2016 helped reduce its workforce by 7pc to 83,000 at the end of last year.

In response to the price downturn, Shell has virtually frozen external hiring and initiated a voluntary redundancy scheme. But more significant changes are likely, given the energy transition and market pressures. "Over the coming months we will go through a comprehensive review of the company. Where appropriate we will redesign our organisation to adapt to a different future," Shell says.

Total is sticking to a hiring freeze, as it did in 2015. Its renewables and upstream acquisitions in 2015-19 actually pushed its end-of-2019 staffing up by 8,000 from five years earlier. Despite this, its wage bill was $8.9bn last year, compared with $9.7bn in 2014, as a result of the big reset on labour costs by it and other majors since 2015. The thinking within Total is that further significant efficiencies are possible without job cuts. And a significant concern for European majors such as Shell and Total — as well as within the wider industry — remains that the growing reputational challenge of climate change will make it harder for them to refill positions if and when the industry recovers, should they cut their workforces too fast and too hard now.