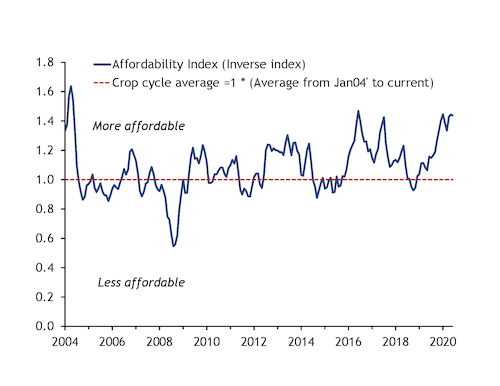

Fertilizer product affordability has remained at its highest since June 2017 for the third consecutive month, according to Argus' global fertilizer affordability index.

Affordability has been 1.44 for June and May, and was 1.43 in April (see chart).

Meanwhile, the fertilizer price index has trended downwards over the past quarter, as a result of lower values for urea, phosphates and potash.

Potash prices have been falling since November 2018, but the potash index bottomed out on 19 March at 90.98, the same week that Israeli potash producer ICL announced Covid-19-related production cuts at its Spanish MOP mines. Prices have since fluctuated, and the index was at 92.96 as of 25 June.

Between March and late June, China and India settled annual contracts at $70/t and $50/t reductions to their previous contract price, respectively, increasing MOP affordability.

In India, a reduction in the nutrient-based subsidy (NBS) meant affordability fell. But potash importer and marketer IPL cut its maximum MOP retail price this year, which, together with the lower contract price, more than offset the NBS reduction.

Other key events included a bottoming out of the granular MOP price in Brazil in April, and a subsequent rise, while other granular MOP prices around the world continue to fall. Brazil went from being the leading destination in terms of price for granular MOP in August 2019 — out of Argus' five granular MOP spot assessments — to the lowest in less than two months, and it has since stayed at this position, as strong demand and competition among existing suppliers and new entrants have led to price falls far exceeding those for any other similar assessment.

Aside from Brazil's price rise, MOP values are either flat or falling. It is unlikely that prices can fall much further, given the slightly positive demand forecast against 2019 levels, so the affordability of potash may drop in the coming months as prices recover elsewhere, as they have in Brazil.

Urea prices weakened from mid-March, falling by $40-50/t from most origins before bottoming out in the second half of May at around $210/t fob Middle East and $205-210/t fob Egypt. The fall coincided with the end of buying for the spring season in North America and Europe.

Prices have since recovered by $20-30/t because of active demand from several areas. Australia had timely rainfall and began to buy heavily, with traders short and needing to cover sales, while India held a series of tenders to buy urea, based on a huge increase in sales in the country.

Urea supply is the key issue at the moment to cover the increased Indian requirement, with substantial Chinese exports needed to meet India's third-quarter demand because there is little increase in supply from other areas.

Urea prices appear stable for the third quarter, in the $220s/t fob Middle East and China.

Phosphate prices fluctuated throughout the second quarter. The Argus DAP index had peaked in late March at 88.66 points, but softened throughout April and May, before firming again in the beginning of June. The index ended the period at 87.71.

Price drivers

Key drivers for the renewed price increase this month were continuously strong demand across south and southeast Asia, which was met by reduced granulation by Moroccan producer OCP as well as re-emerging demand for MAP in Brazil.

India's import demand has been consistently strong throughout the second quarter, with importers lining up 1.6mn t of DAP. A further 986,000t has so far been scheduled for third-quarter arrival.

And Bangladesh's agriculture ministry has increased its annual DAP buy tender by 200,000t compared with 2019 to 600,000t, with first shipments loading in June.

OCP reduced granulation at its plants by 200,000t in June to 650,000t of finished fertilizer, limiting availability for the key buying season for Brazilian phosphate importers.

In Brazil, solid crop economics, which caused barter rates for soybeans to hit four-year lows, supported MAP imports. Brazilian importers received 1.74mn of MAP in January-May, up from 1.07mn t in the same period of 2019. Demand for fresh cargoes emerged in June as the safra application season from September neared, driving up prices.

Crop prices underpinning affordability

Agricultural commodity prices have weakened over the past three months, after hitting high levels in January. Covid-19 has caused a slowdown in demand and impacted the wider economy.

Corn prices on CBOT have dropped by 15pc since the start of this year, averaging $3.29/bushel in June, compared with $3.86/bushel in January. Low domestic demand from the ethanol industry over the past three months, coupled with depressed crude oil prices, have had a heavy impact on prices.

And prices are expected to fall further amid a US acreage expansion this season to 97mn acres and low domestic demand from the ethanol industry, given the effects of the pandemic and the resulting economic slowdown.

Although ethanol production — and subsequent corn use — has climbed incrementally since May, corn consumption remains 30pc lower than in January, and the US Department of Agriculture forecasts an 8pc drop in demand from the domestic ethanol industry.

Wheat prices have fallen by 11pc since January, to $5.01/bushel in June. The UN Food and Agriculture Organisation's latest report indicates that global wheat production is expected to be about 762.6mn t in 2020, similar to 2019, and which would be the second-highest on record. Smaller harvests are expected in the EU, north Africa, Ukraine and the US, but increases are likely in Australia, Kazakhstan, Russia, India and other Asian countries.

In oilseeds, soybean futures have weakened by 6pc, with prices averaging $8.66/bushel in June, compared with $9.17/bushel in January. US crop planting continued to surpass historical rates, while Brazilian oilseed has been strongly competitive in the international market, given the Brazilian's real's depreciation of more than 30pc against the US dollar this year, which makes local commodities more attractive to foreign buyers.

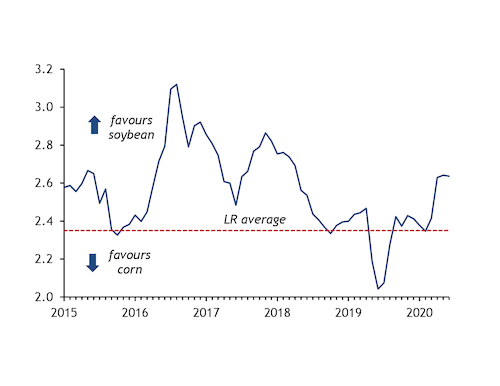

The soy/corn ratio has continued to favour soybeans over the past quarter amid the weaker corn prices and relatively stronger soybeans performance.

Thai rice prices have risen by 13pc compared with January. Spot prices recorded by the World Bank indicate that prices peaked in April, when the benchmark rose to $564/t, compared with $451/t in January. The persistent drought-like conditions in certain Thai regions have impacted agricultural activity since last year.

The Argus Fertilizer Affordability Index is a proprietary assessment developed by Argus Consulting and used in Argus Fertilizer Outlooks. For more information click here

The Argus fertilizer affordability index is a global assessment calculated using the ratio between the fertilizer and crop price index, with the base year set at January 2004. The overall index is adjusted by the crop cycle average. An affordability index above 1 indicates that fertilizers are more affordable compared with the base year, while below 1 indicates lower affordability.

The fertilizer index includes international prices for urea, DAP and potash, adjusted by global usage. The agriculture index includes all major grain prices — wheat, maize, soybeans and rice, and averages by crop tonnage.