This year's Covid-19 pandemic related slump in molybdenum prices has widened arbitrage opportunities for western oxide suppliers into China, with buyers both inside and outside China likely to seize the opportunity to lock-in material under term-contracts before economies and prices start to recover.

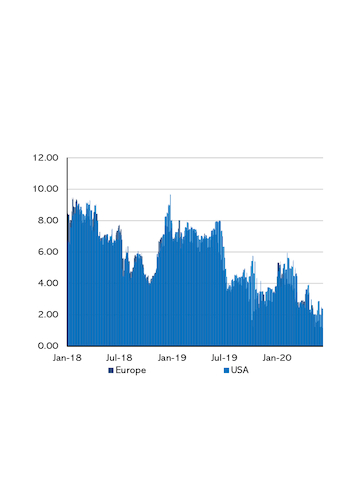

European and US molybdenum oxide prices are currently at three-year lows of $7.20-7.40/lb du Rotterdam and $7.45-7.65/lb fob US warehouse, respectively, with sellers struggling to drum up enough local spot business as lockdown measures drag on. As a result, they are now diverting more material toward China, where demand has already rebounded post-lockdown.

One producer mentioned this week that he had sold over 100t of oxide to China at $0.20/lb higher than the du Rotterdam assessment range of $7.20-7.40/lb. Furthermore, a trader mentioned that he had sold two containers of ferro-molybdenum to Tianjin at $19/kg cif, which is around $1/kg higher than du Rotterdam prices. China's ferro-molybdenum prices are at just over $21/kg including a value-added tax and import tax which, when removed, render this inter-regional trade profitable for both counterparties.

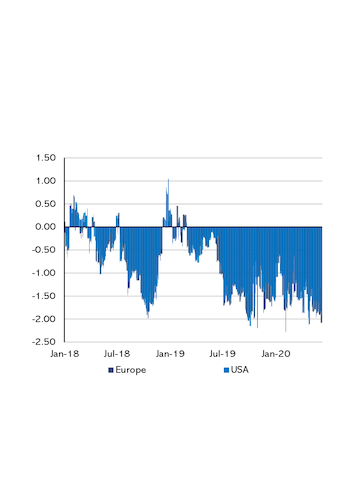

China removed its 20pc export tariff on molybdenum in 2015 after the World Trade Organisation ruled that the tax breached regulations, but it still imposes a 1pc import duty on ferro-molybdenum. Taking these trade terms into account, molybdenum oxide remains around $2/kg cheaper in both the EU and the US when compared with prices in China (see charts). Ferro-molybdenum is usually $1-2/kg more expensive outside China than it is domestically — a product of China's lower smelting costs — but some suppliers outside China are still finding ways to compete on certain cargoes.

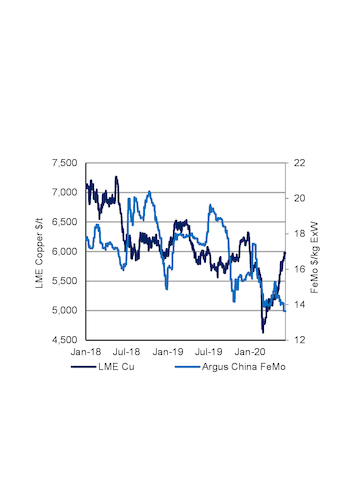

Ex-works China ferro-molybdenum prices shed 24.4pc year on year to reach $13.43/kg on 26 June. Notably, its correlation with copper prices has tightened during the pandemic as shocks to both metals' demand fundamentals happened quickly and in parallel (see chart).

Despite China presenting some opportunities for western suppliers to offload material, the landscape remains unstable and choppy, and European market participants are closely monitoring demand fundamentals — much of which is focused on the oil, gas and automotive sectors — for more robust signs of recovery, which will then bolster both oxide and ferro-molybdenum.

Global molybdenum production totalled 290,000t in 2019, down by 2.4pc year on year, according to the US Geological Survey. Mine closures — particularly in China — accounted for most of the lost production, and led to some tightness in the supply landscape in around the second quarter of 2019. As a result, market participants had previously anticipated robust molybdenum prices in 2020, further bolstered by expectations of demand increasing toward the end of the fourth quarter of 2019, but Covid-19 rapidly did away with these outlooks.