Copper prices have recently staged a sharp comeback as demand expectations return to pre-Covid-19 levels, with fundamentals and cost curves starting to provide more tangible direction to the market after a volatile few months.

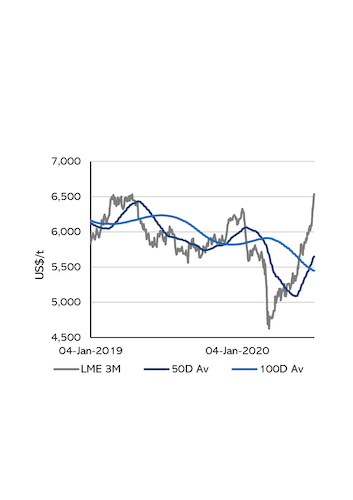

The three-month LME copper contract settled at $6,510/t yesterday, having climbed from $4,626.50/t on 23 March — its lowest since February 2016. Overall, the LME contract slumped by $1,383/t to $4,772/t from $6,115/t between the time of the first Covid-19 recorded death on 1 November 2019 and 1 April 2020 as lockdown measures hit operations across the global supply chain.

Those measures have hit demand — with around 500,000 t/yr capacity of smelter build-outs in China having been scaled back — and supply, such as the refinery and foundry shutdowns at Codelco's Chuquicamata division in Chile, responsible for around 390,000 t/yr of copper production. And prices have lurched sharply as market participants navigated the unfolding narrative, arguably loosening their connection to fundamentals in the process.

The dominant narrative most recently has been that of supply cuts at a number of operations, fuelling the second quarter's price rally. But analysis of the data suggests that the new-found exuberance is not to transport the market to a "new normal" but simply a correction to previous expectations.

Longer positions dominated as demand returned

LME trading patterns indicate that market participants saw the change in price direction ahead of time on 10 January 2020. Positions were almost totally closed out to leave a net long position of just 400t despite having been short by 89,000t the week before. Long positions then dominated trade and accumulated 113,000t in the week ending 27 March when prices sank to $4,474/t — their lowest since 22 January 2016.

Over the same period, the 100-day average for the three-month LME contract fell to significantly below the 50-day average of the same contract — a strong incentive for speculative traders to enter the market on a long basis. That same calculation has since tipped in the other direction, with the 100-day average now below the 50-day by a margin of $200/t — a suggestion that downward volatility might re-enter the market over the coming weeks.

Reports of steep gains may be overblown

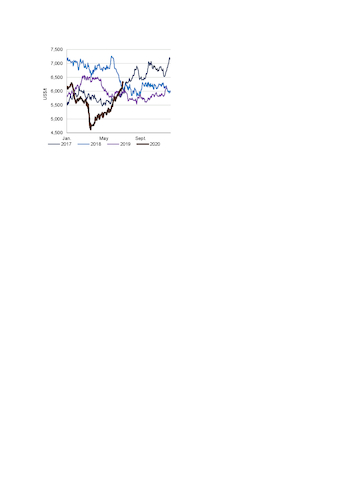

Some short activity is expected given the historical context of where current spot prices oscillate. The recent rebound has built LME three-month prices back to just above the $6,500/t threshold — above where they were in 2018 but on a similar trajectory to 2017 when the refined copper market was in deficit of around 30,000t (see chart).

A review of positions and price relativities only recall the path between 2017 and 2018 expectations, suggesting that the market is correcting back to more fundamental expectations based on the demand for LME-grade material.

Meanwhile, prices for such material in China's secondary market have also been rising lately, with scrap motors facing strong demand as domestic scrap laws force reclaimers to recover environmentally "cleaner" units of copper. Cif Asia prices for bare bright copper scrap were down slightly yesterday at around $2.81/lb, but this marks a steep increase from just below $2/lb on 23 March, Argus assessments show.

Prices above the 90th percentile

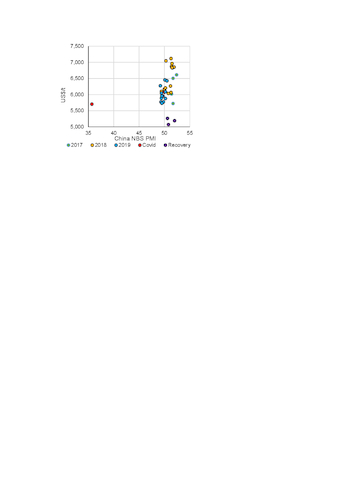

With LME trading activity providing mixed price signals, greater context may be provided by purchasing managers indices (PMIs) and where price levels are currently mapping against the 90th percentile of copper producers' cash costs.

China's PMI stood at 35.7 in February, according to the National Bureau of Statistics, at which point LME three-month copper prices came to a monthly average of $5,704/t — significantly lower than would be expected based on historical correlations between these two metrics (see chart). January's LME three-month price average of $6,076/t tracked against a PMI of 50.0 — a reading more in line with China's composition of spending on commodities.

Meanwhile, as demand rose in recent years, the copper cost curve — always key in shaping price expectations for this metal — has pressured prices down from the $7,000/t levels of 2018 to group more tightly around the $6,000/t levels of 2019 onward. Argus estimates that the 90th percentile of costs remains at around $5,320/t, with LME three-month prices tending to incentivise production at this level. The 2020 year-to-date average is now slightly higher at $5,566/t, suggesting that short plays on the LME might soon weaken upward price momentum.