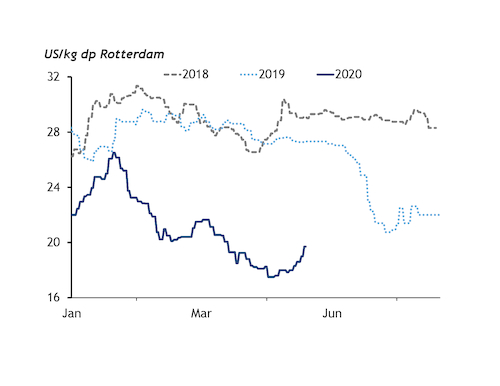

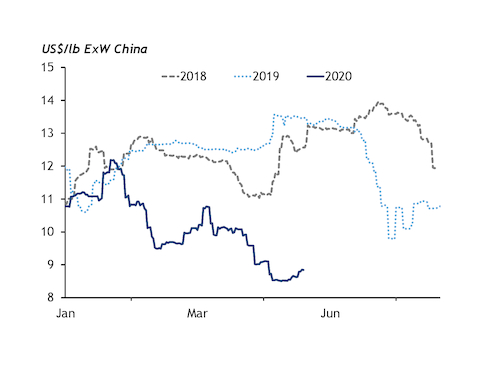

Prices across the molybdenum complex have staged a rally over the past two weeks as a resurgence in economic activity increased physical demand, particularly in Asia-Pacific, while supply disruptions in China induced scarcity.

Prices for 57pc molybdenum concentrates broke through the $8.50/lb ex-works China level on 13 August, while oxide prices in Rotterdam were close to $8/lb. Rising ferro-molybdenum alloy prices because of increased economic activity, primarily in Asia-Pacific, and with notable signs of improvement in Europe, drove oxide prices higher.

Earlier this year, prices for all forms of molybdenum units slumped across the world on lower demand as energy and automotive sectors suffered from lockdown measures and social distancing rules. Some reports from European car manufacturers illustrate that large production facilities continue to struggle to regain 80pc of their previous operating capacities and new sales remain down by 5.7pc to a rate of 14mn annual vehicles across Europe due largely to Covid-19.

Molybdenum prices are the product of demand and supply from diverse sources, but the energy sector represents close to 40pc of all demanded volumes.

Furthermore, China consumes about 44pc of all world units of molybdenum of about 95,000t per year. Yet the region produces about 93,000t, or 35pc, of the world output, making it heavily reliant on imports.

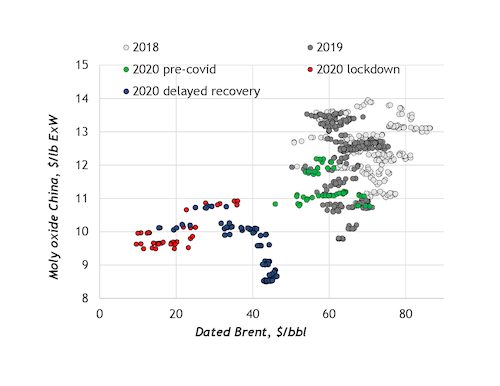

Despite the weak start to the year, rising dated Brent oil prices, which are correlated with global economic performance, signals that demand recovery is under way. Molybdenum prices are positively correlated with the price of dated Brent oil, but analysis shows that current prices for molybdenum oxide in China are lower than the price of dated Brent would suggest.

The relationship shows that Brent prices of about $46/bbl this month would have correlated with a molybdenum oxide price of closer to $11/lb ex-works China pre-crisis, rather than the Argus assessment of $8.84/lb on 14 August. On the other hand, oxide prices have shown to be resilient at the $8/lb ex-works level, even when dated Brent slumped to approximately $10/bbl during lockdown.

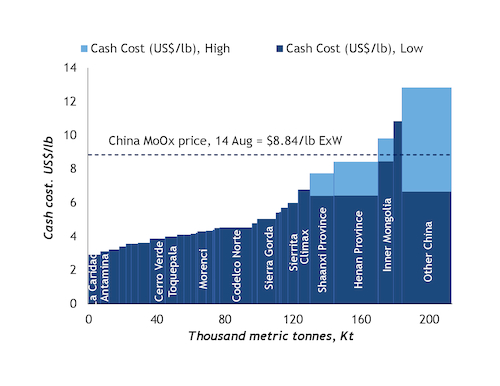

Cost curve, supply disruptions signal oxide tightness

Some Chinese producers have chosen to operate with negative cash margins, at prices of below $8/lb ex-works, according to market participants.

Current prices suggest producers in Shaanxi and Henan remain cash positive, but some production in other Chinese provinces continues to suffer negative margins. But this is likely to change as disruptions across Chinese mines continue.

A tailings dam leakage forced the closure of Yichun Luming's molybdenum concentrates production plant, which still remains off line. Jinduicheng Molybdenum Group (JDC) — a mining firm with production centred in China's Shaanxi province — is likely to be affected by heavy rainfall and flooding for at least two weeks this month, market participants said. Shaanxi produces about 15,000t of molybdenum, or 5.5pc of world production.

Disruptions at Chinese mines will encourage higher-cost mines to produce to fill the supply deficit as demand rebounds. This is likely to push prices higher — above the $8/lb level, the average cost incurred by Shaanxi producers — and likely will lead to increased sales by marginal Chinese producers at above current price levels. These disruptions at Chinese mines of relatively lower-cost volumes will need to be "replaced" by supply from higher-cost domestic producers and sold at a higher price.

The marginal producers in China tend to incur a cash cost of $10-14/lb. Within this range, the price of the marginal tonne will be determined by how much further energy and automotive activity can recover over a period of relatively scarce molybdenum supply. Purchasers of molybdenum will be eyeing the dip in the oil/molybdenum price relationship as a short-term price signal, as demand for both commodities improve at a time of disrupted molybdenum supply.