The surge in Turkish ferrous scrap prices to multi-year highs beyond $470/t in the fourth quarter of 2020 was driven largely by the bull run in the wider global ferrous complex led by pent-up steel demand in China and will likely rely on this run to continue in order to sustain support in the first quarter of this year.

Tight availability of scrap caused by the impact of the Covid-19 pandemic on arisings in key exporting regions has been widely cited as a contributing factor to the surge in the Turkish import price over the past two months, which saw the Argus daily HMS 1/2 80:20 assessment spike by 62pc since 30 October to $472.70/t on 31 December.

But although this tightness of availability certainly has played a small role in the sharp rise, analysis of Argus Turkish deep-sea ferrous scrap deal data for the November-December period, combined with official import data available for the first 10 months of last year, does not paint a picture of a market starved of supply.

In December, Argus tracked 24 deep-sea Turkish ferrous scrap import deals with a combined volume of 667,500t. This is up from 20 deals in December 2019, with tracked tonnage up by 13.2pc from 589,500t.

This followed an even stronger month of trading in November, when Argus tracked 47 Turkish deep-sea ferrous scrap deals totalling a combined 1.44m t, up by 35.8pc from 1.06mn t across 31 deals in November 2019.

Although not all deep-sea deals are disclosed to the market, these year-on-year increases are in line with official Turkish data for all ferrous scrap imports, which is available through to October.

Customs data show that Turkey imported 18.06mn t of ferrous scrap in January-October 2020, a 19.25pc increase from 2019 and the highest volume of imports for this period since 2012. In October, Turkish ferrous scrap imports were up by a staggering 68.82pc on the year to 1.93mn t.

Fundamentally, Turkish mills have not experienced serious difficulty in securing scrap cargoes and certainly not to an extent that would drive a price spike beyond $470/t.

Scrap flows in exporting regions fell in 2020 and export volumes weakened accordingly, but this has affected availability to other markets. Turkey, by contrast, has been a safe haven for global scrap exporters.

The rapid Turkish scrap increase is simply in line with a wider run-up in global steel prices since the start of the fourth quarter of 2020. This has been fuelled by pent-up demand, first from China and then by other industrial economies as manufacturing activity recovered from the initial wave of Covid-19 in the first half of last year.

Scrap-specific fundamentals to exert minimal influence

For participants in the Turkish scrap market, the key issue to consider when attempting to gauge direction in the first quarter of this year and beyond is whether there are any underlying supply and demand fundamentals that can support scrap prices independent of the current global ferrous bull run.

Essentially the question is whether the Turkish scrap price could crash the moment China cools down.

Earlier analysis has indicated availability of scrap to Turkey is sufficiently ample that any drop-off in global steel demand is unlikely to be offset to any great degree by tight supply. But scrap supply could potentially tighten further in the first quarter because of winter weather and renewed, more extensive lockdown restrictions to tackle fresh waves of Covid-19 across all exporting countries. China's return to the ferrous scrap import market and increased duties on Russian scrap exports are also supporting factors.

In this context, if global steel prices remain strong, supply issues would provide an additional top-up boost to Turkish scrap import prices, but they would not offset any sharp downturn in steel demand.

And there are no indications that Turkish steelmakers are in any exceptional position in domestic or export markets to sustain their scrap and steel prices if steel markets in China and the rest of the world were to weaken.

A simple way to gauge this is to compare current Turkish scrap-steel and iron ore price relativity to data from 2018. At that time, the Turkish ferrous market was at its previous highest level over the past six years and notably ran much hotter compared with the wider global complex.

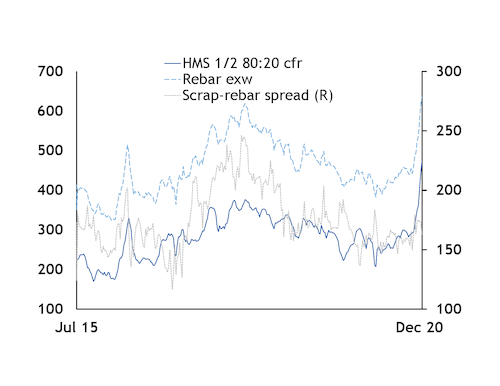

Comparatively tighter margins are a key indicator that Turkey is following a global trend rather than running on its own momentum. The spread between the Argus daily HMS 1/2 80:20 cfr Turkey and fob Turkey rebar assessments averaged $195.13/t in 2018, with mills achieving up to $220/t at times as they leveraged an extremely strong domestic market to achieve favourable export sales.

The average Turkish import scrap-export rebar spread in 2020 was $156.21, down by $38.92/t from 2018 and by $9.56/t from 2019. During the fourth-quarter price surge, the spread averaged $158.80/t, little changed from the full year.

In the domestic market, the 2020 average spread between the Argus daily HMS 1/2 80:20 cfr Turkey and weekly ex-works Turkey rebar (excluding value-added tax) assessments fell to $160.15/t, down by $43.37/t from 2018 and by $12.47/t from 2019.

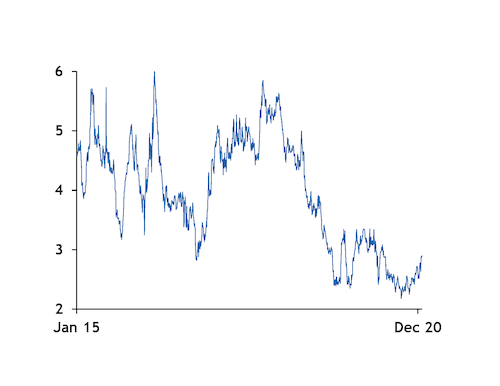

Relativity to iron ore price movement is another indicator that Turkish scrap prices are moving in close concert with a wider global trend. The average ratio from the Argus HMS 1/2 80:20 cfr Turkey price to its ICX 62pc Fe cfr Qingdao index was 2.55 in the fourth quarter of 2020, lower than 2.67 for the full year, as iron ore prices also strengthened in line with higher global steel demand.

By contrast, in 2018, Turkish scrap and steel fundamentals were so strong relative to the rest of the world that the scrap-iron ore ratio averaged 4.91.

Steel demand is expected to remain strong relative to lack of supply in China and other major economies throughout the first quarter of next year. But participants in the Turkish scrap import market should intensify their scrutiny of Chinese steel and iron ore price movement for this period, as it will be activity in this sphere rather than scrap-specific fundamentals that is the key determiner of near-term Turkish price direction.