South Africa's platinum group metal (PGM) producers expect a strong 2021 amid vaccine rollouts, rising consumption and tightening emissions standards globally, although it remains to be seen if recent record highs for metals such as rhodium will be sustainable as buyers feel the pinch.

The metals sector endured a volatile 2020, with demand and prices for PGMs fluctuating as the Covid-19 pandemic took hold in March, shuttering several mining operations and dampening demand from the automotive and jewellery sectors. Conditions stabilised in the second half as manufacturing began to recover, with prices for some metals rising sharply as consumption ramped back up.

Some South African producers expect to build on these gains in 2021, planning to increase production in anticipation of rising demand. Tharisa aims to increase its overall PGM production to 160,000oz this year from 143,000oz in 2020, while Anglo American increased its guidance to 4.2mn-4.6mn oz from the 2.71mn oz produced in 2020.

Supply tightness

The global PGM market is widely expected to remain tight this year, with the deficit potentially deepening for certain products.

The deficit stood at 22,000 troy ounces (toz) for rhodium in 2019, according to US-based Heraeus Precious Metals, which estimates that this deficit stood at 55,000ozt in 2020. The palladium market remained 145,000ozt in deficit in 2020, Heraeus said.

PGM producers expect supply to remain tight this year, in part because South Africa's refiners are running below 100pc capacity amid the pandemic. Anglo American only restarted its converter plant A in December with its B plant still off line, weighing significantly on national PGM refining rates.

Tharisa chief executive Phoevos Pouroulis said the return to work from the Christmas break has not been smooth, with Covid-19 rates rising in the country. "We know that a number of deep level mines have not been able to get up to full capacity after a month owing to the restrictions, people being affected and not returning to work," he said. "You can never catch up that lost production or that lost time. It's gone. So, I think there will be supply side challenges this year still from South Africa."

Rhodium demand outlook strong but prices could slip

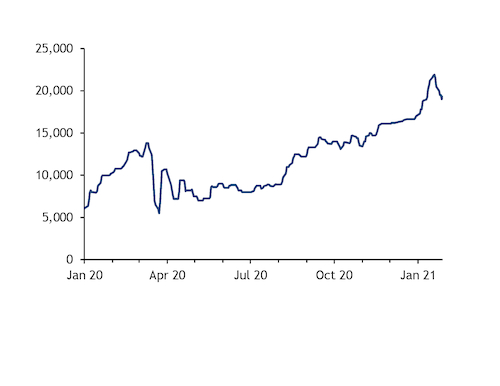

Rhodium demand and prices rose sharply over 2020, largely owing to increased emission standards in Europe and China.

Pouroulis describes rhodium as "irreplaceable" in automotive catalytic converters, where it reduces the nitrogen oxides in exhaust gases. Some other market participants agree that it is the most effective metal for the job but warn that some catalyst manufacturers might start considering substitutions with platinum or palladium if rhodium prices remain in excess of $20,000/toz.

"China is phasing in much stricter legislation, and that requires higher loadings of PGMs to meet those legislative standards," producer Impala Platinum (Implats) corporate relations executive Johan Theron said. "And being in a principally gasoline environment means that it's a big pull on palladium and rhodium."

Hybrid-electric vehicle uptake is also adding to PGM demand in the medium term, Theron said. "In hybrid cars, there is still an internal combustion engine, and it is still required to meet legislative demand. And in fact, because of stop/start technology, even though the engine in a hybrid electric car is smaller, it requires the same or sometimes more PGMs," he said.

South Africa has also suffered disruptions to supply from recycling. "80pc of rhodium comes from South Africa, and another big chunk comes from recycle and recycling flows that were interrupted because of the break and economic activity and movement of goods and people last year," Implats corporate affairs executive Emma Townshend said. "But the refining issues around here [South Africa] have had a very material impact on rhodium and liquidity."

Supply of the metal was cut severely in 2020, because of the lockdowns and low production rates that in turn helped to support prices. Rhodium prices recently hit a record high of $21,900/toz, UK specialty chemical producer Johnson Matthey said, and while they have now slipped to $19,300/toz, they are higher than the industry was previously accustomed to, with prices below $1,000/toz until March 2017.

Townshend said Implats is "very positive on the outlook for rhodium" while Pouroulis said "anything is possible" regarding price hikes. "f you had asked us two years ago whether we'd see these prices, I don't think anyone could have forecast the future point market. But I think importantly from a supply and demand perspective, we're in a very good position."

29012021054731.jpg)