Black Sea export wheat prices have dropped by 11pc over the past week, pressured by an overall fall in global demand for old crop supplies combined with an increase in availability as local producers are selling off stocks in the light of good prospects for 2021-22 wheat production in both Russia and Ukraine.

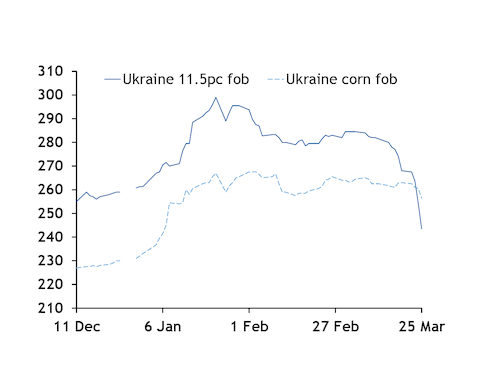

Ukrainian fob wheat prices for 11.5pc protein grade dropped by more than $30/t week on week to close at $243.50/t today — the contract's lowest level since Argus began wheat price assessments in October last year. Ukrainian prices tracked Russian wheat values, which marked a sharp decline, having lost more than $25/t on the week with offer prices falling below $255/t fob today.

Spot Black Sea wheat prices fell under significant pressure from sluggish demand for old crop, as the marketing year approaches its final quarter, with trading liquidity expected to remain slow until new crop wheat arrives in July.

A €50/t export duty on wheat introduced from 1 March has sharply reduced the country's export activity, with March shipments unlikely to exceed 1.2mn t, which would mean a 60pc drop year on year. Ukrainian exports are also slowing, with most of the 17.5mn t export quota volumes for the 2020/21 marketing year having already been shipped or sold forward.

As a result, global buying interest is almost entirely concentrated on new season wheat supplies, still available at a good discount amid expectations of a large 2021-22 harvest in the Black Sea region following an increase in planted areas and the good condition of winter crops.

Ukrainian wheat production is estimated to rise to 29.5mn t in the next marketing year, up by 17.5pc from 2020-21, according to the country's economy ministry, while market estimates of Russian 2021-22 wheat production range from 78-80mn t compared with 85.4mn t harvested this marketing season.

Falling prompt demand, combined with good prospects for the new season's production, have encouraged local producers to spur sales of old crop wheat stocks. That has added further pressure to the export market, with the current downward movement expected to continue in the short term, according to market participants.

Ukraine wheat export prices at discount to corn for the first time since July 2019

A steep drop in Ukrainian wheat prices has also left corn values at premiums this week for the first time since July 2019, when the Ukrainian corn market experienced tight supply at the end of the marketing season, while wheat prices were pressured by the new crop arrival.

The fob spot price for Ukrainian corn closed at $256.50/t today, with a $13/t premium to prices for 11.5pc and 12.5pc protein grade wheat products, respectively, which had held premiums of more than $30/t less than two months ago.

This unusual negative spread between Ukrainian wheat and corn prices may continue for some time, as the corn market's losses are comfortably lagging behind those seen in wheat prices, limited by higher demand amid active exports.

But the ongoing downward moves in wheat prices are likely to pull corn prices further down too, as some importers may decide to switch to wheat as a substitute for corn in feed products, which could affect demand for the product.