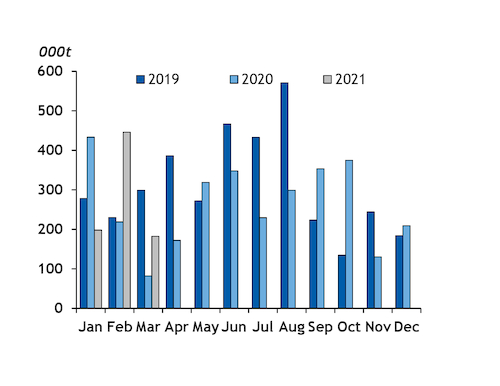

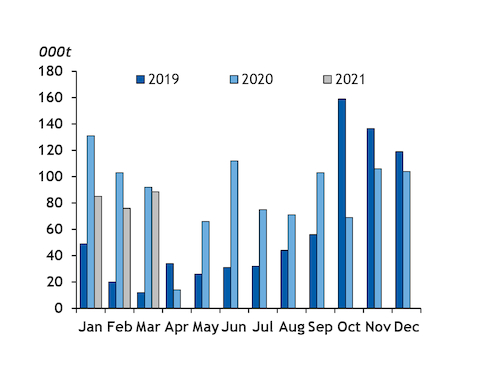

Argus Eurobob gasoline combined volumes fell to 271,100t in March from a 13-month high of 522,000t in February, as Covid-19 travel restrictions were tightened or extended in several European countries. Volumes were up from 174,000t in March last year, when the first pandemic restrictions were in place.

A total of 182,600t of Eurobob oxy barges changed hands on prompt Argus dates in March, from 446,000t in February and an all-time record low of 82,000t a year earlier. Volumes for the first quarter of this year totalled 826,600t, from 734,100t a year earlier.

The seasonal transition contributed to the fall in benchmark Eurobob oxy gasoline from February to March, as the final winter barges changed hands. Summer-grade barges have traded this week at more than $10/bl above North Sea Dated, almost twice that of the final winter barges last week, putting northwest European gasoline margins at their widest since November 2019.

Margins have firmed even though travel restrictions have returned of been tightened in several European countries, which will have dampened physical demand last month. France will enter a new, [nationwide lockdown for four weeks from 3 April]( https://direct.argusmedia.com/newsandanalysis/article/2201485), in an attempt to stem rising Covid-19 cases.

Trading firm Gunvor was largest buyer of Eurobob oxy last month, securing 57,000t in March after nothing in February. BP, Shell and Total each bought just over 20,000t. The remainder was purchased by BMV Mineral, Finco, Garant, Gunvor, Hartree, Litasco, Mabanaft, Macquarie, Trafigura, Vitol and Varo.

Participation increased to 14 from 11 the previous month, with German wholesaler Garant buying their first Eurobob barges included in the Argus assessment. Russia's Litasco was the largest seller, parting with 48,700t in March, from 38,000t in February. Total sold 42,500t from nothing the previous month, and Shell and Hartree each sold over 20,000t, from 28,000t and 12,000t, respectively, in February. Mabanaft, Macquarie, Trafigura, Varo and Vitol sold the remainder.

Non-oxy barge volumes reached 88,500t in March, from 76,000t in February and 90,000t a year ago. Volumes in the first quarter totalled 249,500t, down from 327,000t a year ago.

Refiner Varo was again the largest buyer, securing 48,500t of non-oxy gasoline in March, from 54,000t in February. Litasco purchased 16,000t and Shell 12,000t in March, after neither took any in February. ExxonMobil, Gunvor and Van Raak bought the remainder.

Total was the largest seller for a second month, parting with 58,000t in March from 22,000t in February. Litasco sold 12,000t, from nothing in February. ExxonMobil, Phillips66 and Shell sold the remainder.