Transactions involving iron ore lump have slowed in the seaborne and Chinese portside markets with higher prices, rising metallurgical coke values and increased demand for sintering ores.

The Argus 62pc Fe iron ore lump premium softened to 50.4¢/dry metric tonne unit (dmtu) on 12 May from a record high of 57.70¢/dmtu on 26 April. The lump premium had breached 50¢/dmtu in March this year.

Lump premiums were supported earlier in the year on tighter availability of mainstream cargoes and higher coke prices. Sintering curbs at Tangshan further supported demand, although blast furnace restrictions checked gains.

The lump premium at 50.4¢/dmtu is equivalent to an outright price of $266.80/dmt cfr China, based on the underlying ICX 62pc fines index at $235.55/dmt cfr Qingdao. The lump premium is for every 1pc Fe unit in lump above the underlying 62pc fines index.

"A mill bid a cargo of Pilbara Blend Lump (PBL), with a 25 May-4 June laycan, at $0.25/dmtu on the Corex platform on 10 May," a Beijing trader said. "The low bid shows buyers' limited appetite for lump cargoes."

Lump premiums are expected to dip further, market participants said, as the outright prices of seaborne PBL and Newman Blend Lump (NBL) cargoes were high, leaving no profits when landing such cargoes at Chinese ports for sales in yuan. "Sales in the portside market have been dull because some mills have lowered their lump use ratio," a Shanghai trader said.

Some mills, especially in Hebei shifted blends away from lump in response to the high premiums since late March by using non-mainstream or lower grade lump instead.

"We shifted from high-grade lump to low-grade lump in April, though our lump ratio is stable at 5-8pc," a Hebei mill manager said. "PBL is being offered above Yn1,900/wmt and such high prices have curbed demand."

"Some mills have also raised the proportion of sintering ores, thereby lowering their lump requirements," a Hebei mill buyer said. "They usually blend concentrates and Iron Ore Carajas with low-grade Indian Fines for sintering, or just use a blend mainstream medium-grade fines including Pilbara blend Fines (PBF)." The rise of medium and high-grade fines prices was sharper those for lumps, he added. The Argus ICX 62pc index hit a record high of $235.55/dmt cfr Qingdao on 12 May with the surge in downstream prices.

Market participants also pointed to the rise in metallurgical coke prices as a factor denting lump use and supporting high-grade fines demand.

"Metallurgical coke prices have seen six rounds of increases adding to 600 yuan/t since early April," a Hebei mill manager said. "The sharp increase in coke prices dented lump usage."

The portside lump premium has fallen sharply in the past few days to around $0.30-0.40/dmtu, while the seaborne lump premium stayed at higher levels, a Singapore-based trader said. "Seaborne lump premium should follow the portside prices lower, especially as demand wanes during the rainy season," he added.

"On 10 May we estimated the portside lump premium at $0.3093/dmtu with PBF at Yn1,647/wmt and PBL at Yn1,880/wmt," a Handan mill buyer said.

"The port stocks of PBL at Shandong decreased, while those of NBL increased in the past week," a north mill buyer said. "At Qingdao and Rizhao ports, PBL stocks were at a low at 250,000t, while inventories of NBL were subdued at 640,000t."

"PBL and NBL supply was tight the past few months but shipments started to increase from early May, and it is expected that supply will continue to rise in the near future," a north China mill buyer said.

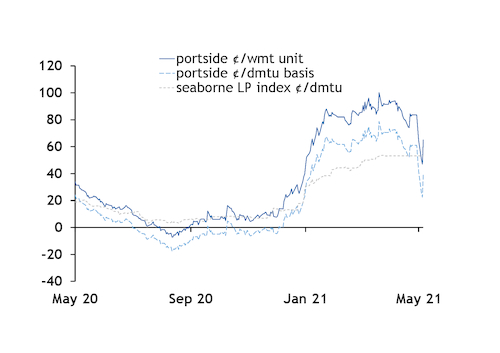

The spread between lump and fines at the portside market has narrowed at a faster pace than in the seaborne segment, indicating that the reduced demand for lump cargoes is more apparent in the portside market. A Newman Blend Lump cargo traded at a premium of $0.52/dmtu on 14 May, underlining the slow decline in seaborne levels.

The seaborne 62pc lump and fines price gap was $31.25/dmt on 12 May, down from a $32.90-35.85/dmt range in April. The portside gap between PBF and PBL shrank to Yn286/wet metric tonne (wmt) ($44.33/wmt) at Shandong ports, or a seaborne equivalent lump premium of 65¢/wmtu, down from the range of Yn319-402/wmt ($49.48-63.35/wmt) in April. Portside premiums briefly touched 100¢/wmt unit last week.