Australian rail firm Aurizon is seeing early signs of a recovery in Australian coal exports, leading it to forecast a 5pc increase in its hauled coal volumes for 2021-22 from the 202.1mn t it transported in the 2020-21 fiscal year to 30 June.

The impact of Covid-19 and Beijing's restrictions on Australian coal weighed on Australia's exports in 2020-21 but mining firms have found alternative markets and haulage rates were up in July with some of Aurizon's competitors jostling for network access, Aurizon executives said today. The firm reported underlying profit of A$533mn ($395mn) for the year to 30 June, which was in line with the previous year, as weaker performance from its coal division was offset by stronger earnings from its bulk commodities business that includes iron ore and agricultural products.

Aurizon's volumes of coal hauled fell by 8.5pc in New South Wales (NSW) and by 4.3pc in Queensland in 2020-21 compared with the previous year. The volume of coal hauled on Aurizon's coal network in Queensland by Aurizon and third party rail-haulage firms fell to 208.3mn t in 2020-21 from 226.9mn t a year earlier.

Aurizon expects to haul around 212mm t across NSW and Queensland in 2021-22, compared with initial guidance of 210mn-220mn t issued a year ago for 2020-21 and guidance of 220mn-230mn issued in August 2019 for 2019-20.

Total contracted tonnage in 2021-22 is forecast to fall by 5pc compared with a year earlier, as New Hope's New Acland Coal mine reaches the end of its life in December and an old contract in NSW comes to an end. Aurizon secured contract extensions with global mining firm Glencore's Newlands, Goonyella and Blackwater mines, although this does not include the Hail Creek mine. There are few new contracts or renewals in the next 3-4 years, with haulage fees largely set for this period, according to Aurizon.

Rail haulage fees have been under pressure over the past few years because of lower than expected coal exports, but under investment in the rail businesses could see fees under pressure again in the medium term.

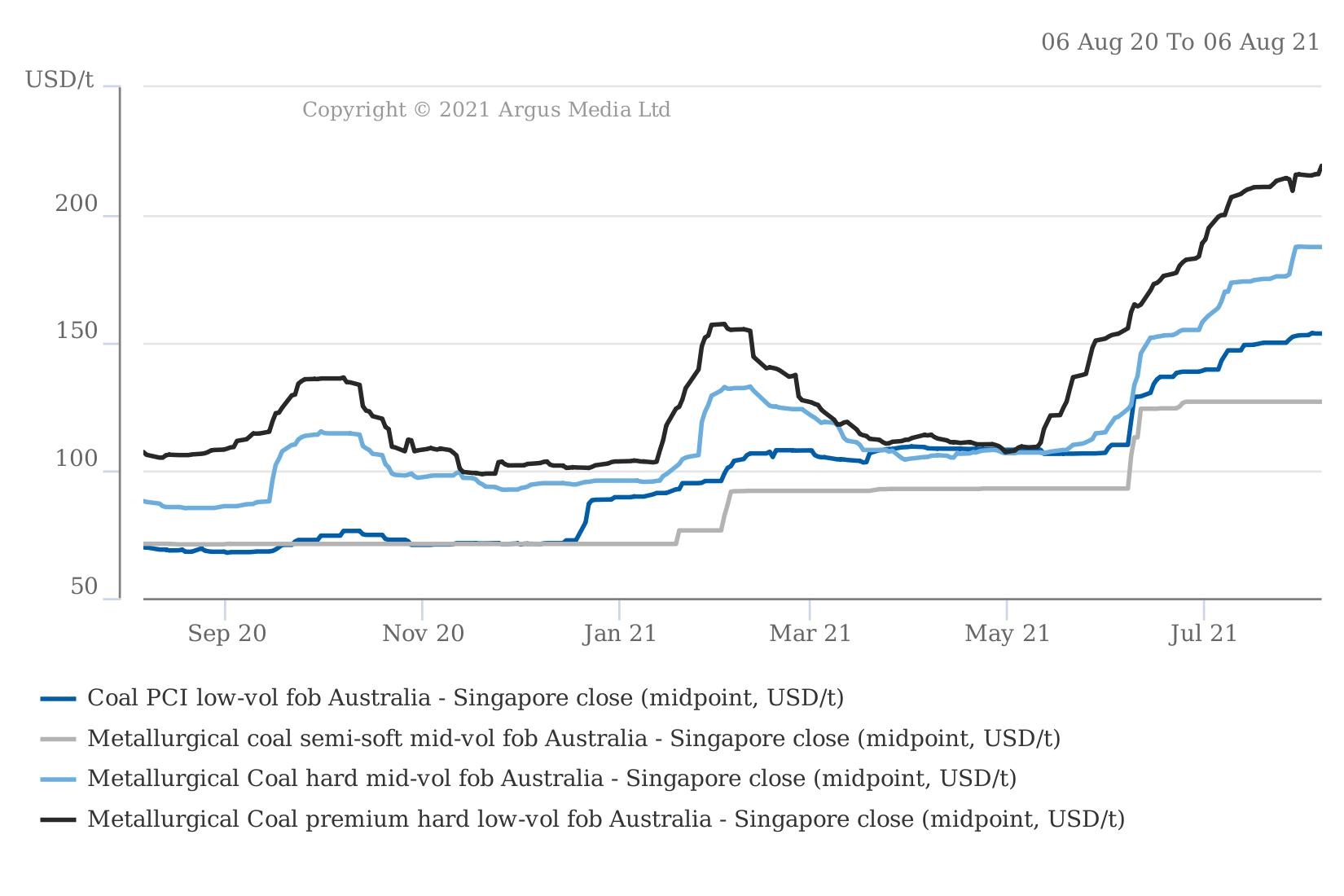

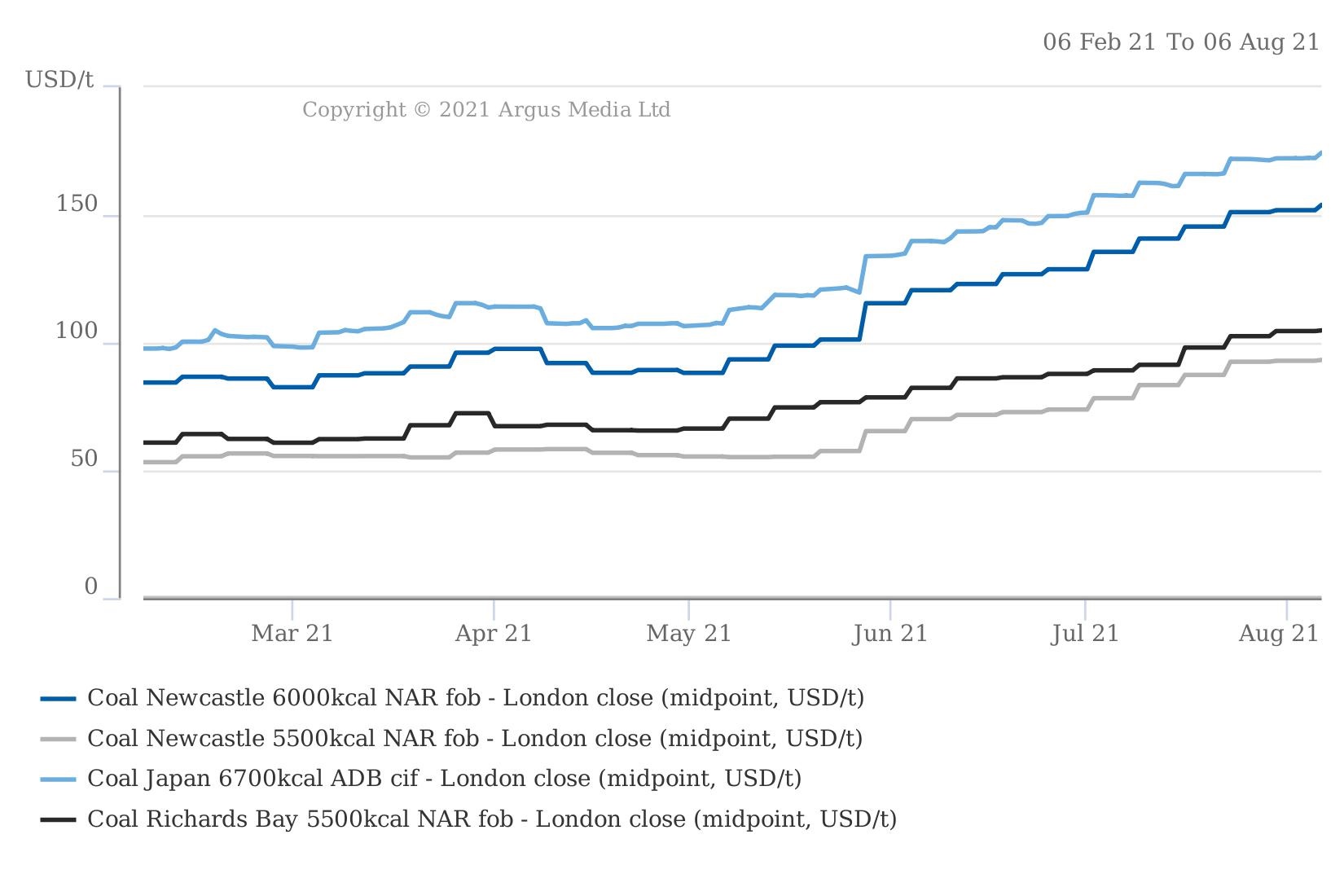

Argus last assessed the premium hard low-volatile coking coal price at $219.25/t fob Australia on 6 August, up from $155.25/t on 8 February and from $103.50/t at the start of January. It assessed the high-grade thermal coal price at $153.99/t for 6,000 kcal/kg NAR on 6 August, up from $84.41/t six months earlier.

| Aurizon coal results | (mn t) | ||||

| Apr-Jun 2021 | Jan-Mar 2021 | Apr-Jun 2020 | 2020-21 | 2019-20 | |

| Coal hauled by Aurizon rolling stock | |||||

| Central Queensland coal network | 37.0 | 35.5 | 38.8 | 143.7 | 150.1 |

| NSW and south Queensland | 14.8 | 13.0 | 17.0 | 58.4 | 63.8 |

| Total | 51.8 | 48.5 | 55.8 | 202.1 | 213.9 |

| Central Queensland coal network volumes (incl third party rail-haul firms) | |||||

| Network volumes | 208.3 | 226.9 | |||

| Source: Aurizon | |||||