South Korean coal prices rose this week, thanks to firmer freight rates and tight coal market availability owing to a force majeure declared by a Russian mining firm.

A major thermal coal producer operating in Russia's Sakhalin island declared a force majeure on coal loadings this week amid disruption caused by heavy rainfall across the far east region, sources told Argus.

South Korean independent power producer GSDEP, which procured 120,000t of minimum NAR 5,300 kcal/kg Sakhalin coal on 22 June for loading between the second half of September and the first half of October in two lots, was directly affected by the force majeure and was reportedly looking to increase volumes through existing term tenders.

Argus assessed NAR 5,800 kcal/kg coal prices at $137.79/t fob Newcastle and $156.04/t cfr South Korea this week, up by $4.05/t and $7.61/t on the week, respectively.

South Korea-delivered prices rose more sharply this week, thanks to strong freight rates. The average Capesize freight rate between east Australia and South Korea rose to $20.70/t, up by 44¢/t on the week and $9.92/t on the year.

There were no tender awards in South Korea this week as utilities' coal inventories will last until at least September, sources said.

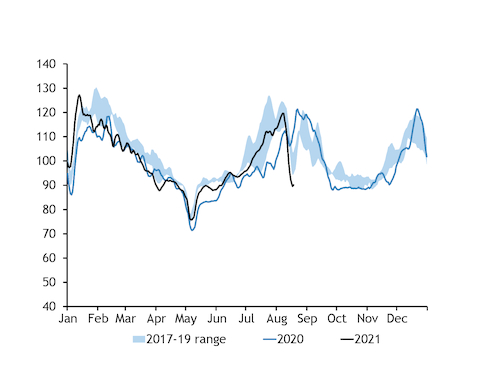

South Korea's coal-fired generation will probably remain firm in the near term, assuming power demand continues to rise on the year. Argus estimates that South Korean coal-fired output averaged 27.2GW last month, based on state-owned utility Kepco and government data, implying a year-on-year increase of 2.1GW.

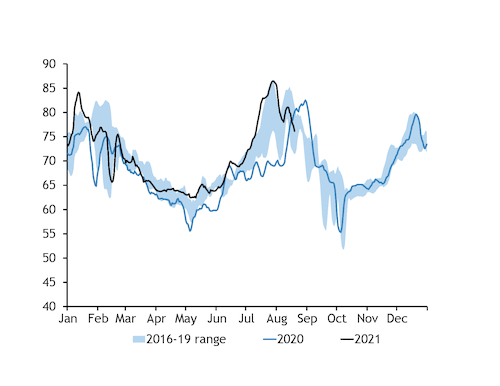

Gas-fired output could have grown by around 9GW on the year in July, thanks to a surge in power demand and a nuclear shortfall, according to Argus analysis.

The Hanul 3 reactor resumed operations on 19 August at 01:67 South Korea time and is scheduled to reach full output on 21 August, according to Korea Hydro and Nuclear Power (KHNP). KHNP's nuclear availability is scheduled to average 17.1GW this month, compared with 16.8GW a year earlier.

Restrictions across the South Korean coal fleet remain minimal, with only the 500MW Samcheonpo unit 6 off line for maintenance since 1 October 2019. The unit is scheduled to return on 31 August.

South Korea's coal availability is scheduled to average 36.4GW in August with the commissioning of the 1GW Shin-Seocheon unit 1 in June. The country's coal-fired generation averaged 27.5GW a year earlier.

Coal price increase in Japan could trigger fuel-switching

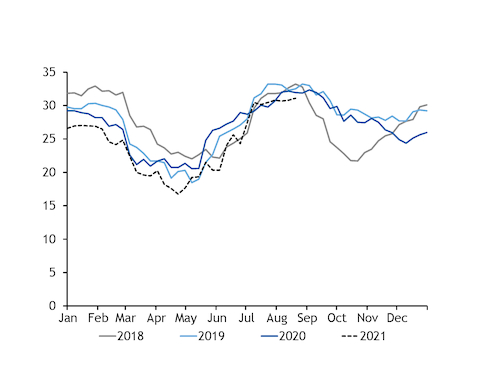

Strength in the Asia-Pacific coal market boosted net-forward coal prices to Japan this week, while firmer coal prices relative to oil in recent months have helped high-efficiency gas-fired units running on oil-linked LNG become increasingly competitive with coal in Japan.

Japanese wholesale power prices for day-ahead delivery on the Japan Electric Power Exchange (Jepx) dropped by 12.6pc on the week to ¥7.44/kWh ($63.81/MWh) amid weaker seasonal power demand. Japanese power demand is currently under pressure from weaker economic activity owing to cooler weather and prolonged heavy rainfall across the country.

Weaker power prices combined with firmer coal prices have reduced theoretical margins for 44pc-efficient coal-fired units for day-ahead delivery to an average of ¥454/MWh over 13-19 August, compared with ¥2,284/MWh the previous week. The equivalent margins for oil-linked LNG generation from 58pc-efficient oil-linked LNG-fired units were at ¥667/MWh over the period, which could trigger some coal-to-gas fuel switching in Japan in the near term.

Generation margins for gas-fired units in Japan running on spot LNG remained in a negative territory this week.