The spot price for biodiesel grade rapeseed methyl ester (RME) has tumbled over the past three sessions, driven lower by a surplus of physical product and a forthcoming change to proof of sustainability (PoS) requirements for the Argus assessment.

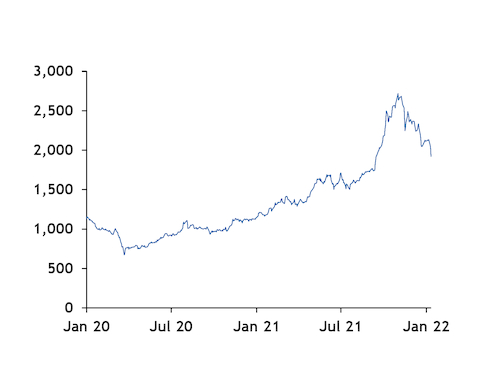

The Argus RME fob ARA range prompt premium dropped by $240/t — or 17pc — between 7-12 January, and the prompt outright assessment by $212/t over the same period. Gains to the underlying gasoil price slightly softened the fall. The outright settled at $1,922/t on 12 January, the lowest since 15 September.

The steep fall altered pricing dynamics across the biodiesel complex, squeezing the spread between RME and fatty acid methyl ester (Fame) 0 to a more than three-month low, and setting the price for waste-grade used cooking oil methyl ester (Ucome) higher than RME for the first time since 17 September.

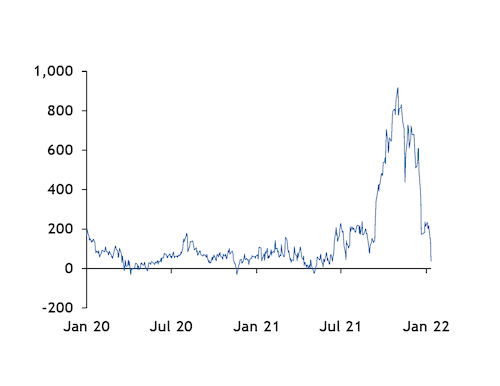

Supply is strong, owing to a temporary glut of RME arising from producers taking advantage of healthy margins in late 2021, participants said. Although RME feedstock rapeseed oil (RSO) reached repeated record price highs in the second half of 2021, the prompt RME fob ARA range/RSO fob Dutch mill spread averaged $537.18/t between September-December 2021 — up by more than 900pc year on year.

Supply has surged as the market prepares for a change to RME PoS requirements for the Argus price assessment on 1 April. This will see RME changing from carrying mass-balanced PoS — meaning physical RSO-based biodiesel can be sold with sustainability paperwork for other vegetable oil feedstocks — to holding RSO PoS, aligning the physical product with its sustainability papers. This change is line with changes to EU member state legislation that limit or ban vegetable oil feedstocks such as palm oil and soybean oil.

Participants in the northwest European market indicate a prompt premium for trade of RME with RSO PoS at around $50-60/t to RME with mass-balanced PoS, although there have been no recent trades.

The PoS change coincides with a seasonal drop in demand for RME — a winter grade, with a cold filter plugging point (CFPP) of -13°C — spurring sellers to shift excess product while there is demand for physical low-CFPP product remains.

But the decline, although sharp, must be viewed in a wider context — the RME outright remains 59pc higher on the year and 74pc higher than in the same time period for 2020. Rising biodiesel mandates in EU member states will drive long-term consumption, and an EU phase-out of feedstocks deemed at high risk of indirect land use change will exacerbate this, placing demand on domestic EU crops such as rapeseed.