Wood pellets may maintain their competitive advantage over coal in the coming winter and until at least the end of 2023, forward price indications suggest.

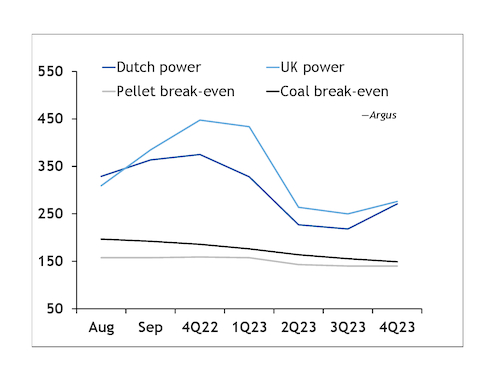

The wood pellet break-even price — which would be sufficient for a pellet-fired unit to cover fuel costs at break-even — continues to hold well below the emission-adjusted coal break-even price for units of 40pc efficiency, Argus calculations show (see chart). This suggests that there could be strong incentive to burn pellets over coal at co-fired units through to the end of next year.

The spread is wider for periods nearer to the current date, with pellet holding a cost advantage of around €37/MWh over coal for deliveries in August-September, Argus calculations show — when using coal swaps for cif Amsterdam-Rotterdam-Antwerp and emission prices from 5 July, and the cif northwest Europe (NWE) spot wood pellet price from 29 June. But the spread narrows for the winter 2022-23 season and throughout all of 2023, offering a stronger incentive for utilities to burn pellets in the second half of this year and until the end of the coming heating season.

But some expect that the shape of the forward coal curve may change and that coal prices could increase further for deliveries in the winter and later in 2023, provided that demand for coal continues to increase in line with recent trends. And coal supply could get tighter as sanctions over Russian coal kick in and coal and lignite producers in Europe — particularly Germany, where demand could increase significantly — may not be able to meet all of the additional demand, should they reverse recent years' decline in output.

European governments have in recent weeks passed legislation amendments to allow for stronger coal-fired generation in the short term. This is to offset a drop in gas consumption, in an effort to replenish gas inventories ahead of the start of the 2022-23 winter season. The Dutch government lifted a cap on coal-fired generation in late June, and Germany has followed with similar amendments this week. These could significantly bolster demand for coal later in the year.

Stronger generation at co-fired power plants — particularly in the Netherlands — may result in stronger power sector demand for pellets. The competitive advantage of pellets over coal for the remainder of 2022 and throughout 2023 suggests co-fired utilities could prioritise pellet burn should coal, emissions and power spot prices realise at current forward curve levels.

Burning pellets has been cheaper than coal since May 2021, which resulted in record-high pellet-fired generation last year. But although power prices continued to hold firm and the price incentive to generate from pellets remained, pellet-fired output dropped significantly on the year in January-June. This is primarily because of tight supply and rising costs for raw materials, delivery delays, and many utilities bringing forward outages or extending maintenance to cope with shortages in supply and the rising pellet prices.

Wood pellet availability is expected to remain tight for the remainder of 2022 and into 2023, suggesting that despite the strong incentive — bark spreads hold at significantly high levels for most NWE markets — pellet-fired power output in NWE could be limited by supply bottlenecks. Russian pellets will not be delivered to Europe from 10 July as sanctions kick in — likely to take around 1.3mn t/yr of SBP-certified wood pellet and chips out of the market. Tight raw material availability in the Baltics and Iberia could limit production in these regions.

In north America, raw material availability remains at healthy levels but other production costs have increased significantly, rising close to or even above long-term offtake contractual prices. Buying counterparties are thought to be unwilling to renegotiate contract prices for north American product, which could result in producers delivering the minimum required contractual volumes. This, in turn, would add to the tightness in supply availability.