Coal shipments from the Australian port of Dalrymple Bay Coal Terminal (DBCT) fell to the lowest level in July in over five years, as India turned to Russia to replace high-priced Australian coal.

Queensland's coal shipments continue to lag behind those in an already depressed 2021.

The ports of Hay Point, DBCT, Abbot Point and Gladstone shipped 15.26mn t of coal in July, down from 17.36mn t in June and from 16.87mn t in July last year, according to port data. The ports shipped 109.6mn t of coal in January-July, down from 116.51mn t a year earlier, putting them on track to dispatch less coal this year than the 197.29mn t shipped last year and the peak of 219.24mn t in 2019.

DBCT shipped 3.21mn t of coal in July, down from around 5mn t both last year and in 2019 . The port is being significantly underutilised, Dalrymple Bay Infrastructure (DBI)'s chief executive of operations Anthony Timbrell said at the company's presentation of its annual financial results on 29 August. It shipped 24.9mn t in January-June at an annualised rate of around 50mn t/yr compared with its capacity of 84mn-85mn t/yr. "We have seen exports to India drop off as India imports more Russian coal," Timbrell added.

DBI is pushing ahead with studies into expanding DBCT to 99.1mn t/yr, although it is unlikely to be in a position to get approval early next year, particularly as it has not finalised negotiations to determine access fees for existing users at the previously low-cost port. The ongoing port fee negotiations may be leading some users to cut throughput at the port, although all are on take-or-pay contracts that require them to pay for set volumes of throughput irrespective of whether these are used.

Ship queues remain around average at the four main Queensland coal ports, with 28 vessels waiting outside the adjacent ports of DBCT and Hay Point, down from 29 on 25 July; 25 vessels outside Gladstone, up from 15; and four at Abbot Point in line with a month earlier.

Abbot Point shipments rebounded to 2.73mn t in July from 2.14mn t in June and 2.38mn t in July last year, but January-July shipments are still lagging behind those a year earlier, despite Indian conglomerate Adani's 10mn t/yr Carmichael coal mine, which ships from this port, looking to increase production after it delivered its first coal to the port at the start of January.

Hay Point, operated by coking coal joint venture BHP Mitsubishi Alliance (BMA), is the only port of the four to be tracking ahead of 2021 year to date, despite BHP withdrawing all investment following the Queensland government increasing royalties from 1 July.

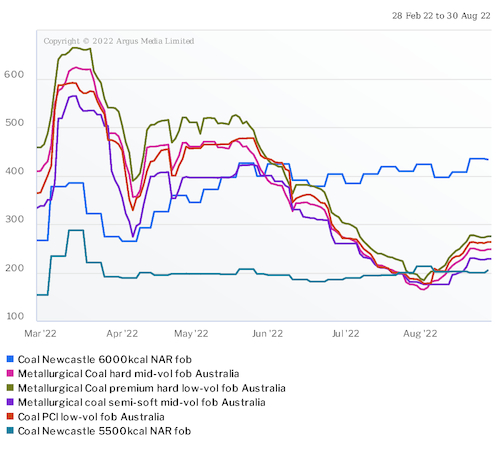

Gladstone shipments also fell sharply in July as coal mining firms considered options to sell thermal rather than metallurgical coal to capture price premiums.

| Queensland coal shipments | mn t | ||||

| Period | Hay Point | Abbot Point | Dalrymple Bay | Gladstone | Total |

| Jul '22 | 4.17 | 2.73 | 3.21 | 5.15 | 15.26 |

| Jun '22 | 4.06 | 2.14 | 5.00 | 6.17 | 17.36 |

| Jul '21 | 3.08 | 2.38 | 4.99 | 6.41 | 16.87 |

| Jan-Jul '22 | 28.09 | 16.78 | 27.74 | 36.99 | 109.60 |

| Jan-Jul '21 | 27.92 | 17.34 | 30.39 | 40.86 | 116.51 |

| Sources: GPCL, NQBP | |||||