Diesel sellers have a lot less flexibility in the face of soaring gas costs than they did in autumn last year, writes Benedict George

A natural gas price spike in August has fuelled steep gains in European diesel margins, although market participants say the market is well balanced.

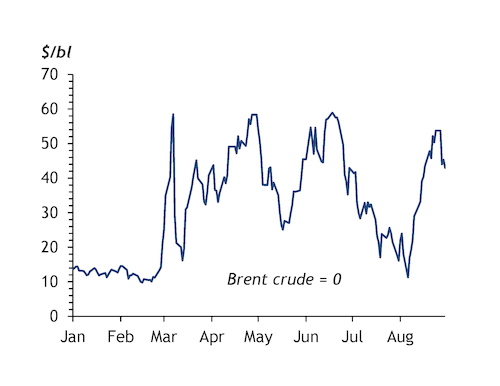

Non-Russian origin diesel cargoes hit premiums of well over $50/bl to Brent crude in late August (see graph). But a key driver appears to be one specific component of refining costs, because — as market participants say — falling European demand is being comfortably met by high imports and refining output.

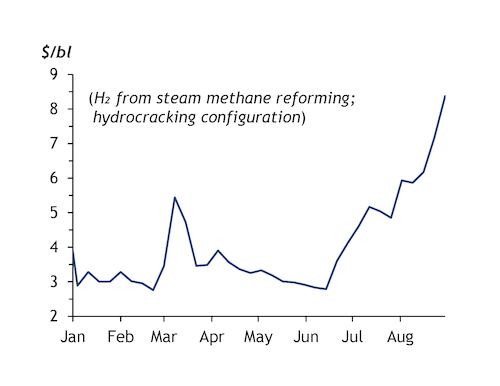

Refineries use hydrogen as an input for hydrocracking and desulphurising. The former converts heavier feedstocks mainly into diesel. The latter reduces the sulphur content of fuels, to meet environmental regulations. Altogether, this means that hydrogen is a particularly large component of diesel production costs. Refineries get some hydrogen as a by-product of naphtha reforming, but generally need to top that up with hydrogen extracted from natural gas.

The cost of hydrogen extracted from natural gas by steam methane reforming has trebled since mid-June (see graph). This reflects how Argus' TTF day-ahead benchmark European gas price rose by around 60pc in August alone because of severe constraints on the Nord Stream pipeline, which Russia's Gazprom uses to supply gas to Europe. Capacity was limited to 20pc in late July, before Gazprom announced that it would take the pipeline completely off line for maintenance on 31 August-2 September.

Diesel margins increased to a two-month high on 26 August, in step with natural gas prices, supporting the view that the latter are substantially driving the former. The TTF gas benchmark and the diesel premium to benchmark North Sea Dated crude gave up around a third and a sixth of their values, respectively, in the following few days. Oddly, backwardation in the paper diesel markets, or the prompt premium to forward prices, became shallower while diesel premiums to crude made gains last month. The smaller prompt premium would normally suggest growing near-term supply relative to demand, while the stronger margin would tend to suggest the opposite. But the forward curve is responding to pressure from crude markets, where backwardation has flattened on the back of more ample supply in recent weeks.

Lack of flexibility

The dislocation may also reflect how diesel sellers are entering this gas crisis with much less flexibility than they had during the minor gas crisis of autumn last year. When gas prices soared then, the inverse dislocation was observed in the diesel market — backwardation grew steeper while premiums to crude remained roughly constant. That prompted trading firms to sell diesel from storage, to meet any prompt supply shortfalls. Then refiners could cut their gas costs by reducing hydrocracker runs or even switching the units off altogether.

But middle distillate inventories are now much tighter. EU-16 middle distillate stocks fell close to a 10-year low of under 369mn bl in July, down by around 60mn bl on the year, according to Euroilstock data. The sell-off of inventories has left sellers with much less flexibility, particularly at a time when they need to be carrying out precautionary stockbuilding in the event of a severe energy deficit as sanctions on Russian seaborne oil imports tighten at the end of this year. Refiners have had to keep running hydrocrackers as natural gas prices have soared again and build the cost into their margin.

Refiners are also likely to be running low-sulphur vacuum gasoil (VGO) through their hydrocrackers as much as possible, rather than high-sulphur VGO, market participants say. This enables them to save on the cost of desulphurising the product, a process that requires hydrogen and is now very expensive.