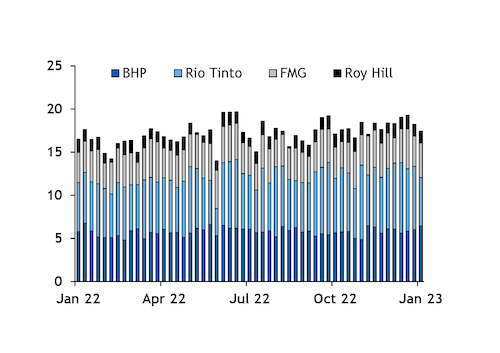

Shipments from the four largest iron ore producers in Western Australia's (WA) Pilbara eased in the week to 7 January after a strong end to 2022, as Rio Tinto's deliveries fell following the end of its financial year.

Rio Tinto, BHP, Fortescue and Roy Hill loaded vessels with a combined 17.45mn deadweight tonnes (dwt) of capacity, down from 18.22mn t in the week to 31 December and from a six-month high of 19.3mn t in the week to 24 December, according to initial shipping data collated by Argus. The dwt tonnage is the maximum capacity of the vessel and overestimates actual shipments by around 5pc.

Initial shipping data suggests that Rio Tinto shipped around 2mn dwt less iron ore in 2022 than in 2021, while BHP's shipments remained roughly stable. Fortescue's shipments increased by around 6mn dwt and Roy Hill's by 5mn dwt. Rio Tinto shipped 321.59mn t of iron ore on a 100pc basis from WA in 2022 .

Only around 5mm of rain fell in the Pilbara in the week to 7 January, despite Cyclone Ellie causing major flooding further north in WA. Up to 25mm of rain fell in iron ore mining regions of the Pilbara on 10 January, but the Australian Bureau of Meteorology is not forecasting any rain in the week to 17 January.

Rio Tinto's exports fell to a four-month low of 5.62mn dwt in the week to 7 January, after being above 7mn dwt for each of the previous weeks and hitting 8.17mn dwt in the week to 17 December. This was 13pc below the rolling average for the past year of 6.44mn dwt/week in the latest week.

BHP loaded vessels with 6.46mn dwt capacity, up from 6.01mn dwt in the week to 31 December and 12pc above its rolling average of 5.77mn dwt/week. This is the most that BHP has shipped in a week since early November and may mean that it has completed some of the upgrading work at Port Hedland. Fortescue's shipments were 6pc above average at 3.99mn dwt, up from 3.47mn dwt the previous week. Roy Hill's deliveries were stable at 1.39mn dwt in the week to 7 January and were 10pc above average loadings of 1.26mn dwt/week.

China was listed as the destination for 82pc of shipments in the latest week, which is around average.

The Argus ICX iron ore was last assessed at $121.55/dry metric tonne (dmt) cfr Qingdao on a 62pc Fe basis on 10 January, up from $86.80/dmt on 7 November.