US Gulf coast petroleum coke's discount to a number of coal origins continues to narrow after a drop in coal prices globally.

Delivered Amsterdam-Rotterdam-Antwerp (ARA) 6.5pc sulphur coke prices remained almost flat in January-February in the low-to-mid $150s/t, while coal prices were under pressure from lower consumption and high stocks during a warm winter in the region, as well as because of lower gas prices. The cif ARA coal daily index price fell by 36pc since the beginning of the year to a low point on 9 February of $119/t cfr — the lowest since 30 November 2021. It has since recovered but is still low in comparison with coke prices.

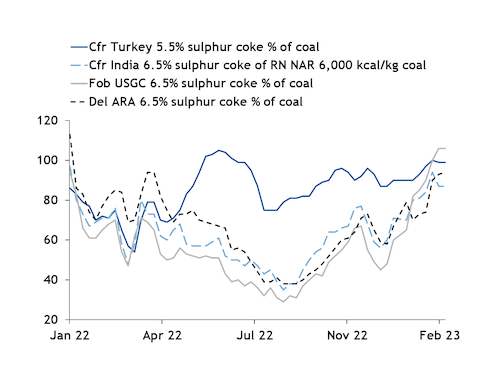

On a delivered ARA basis, 6.5pc sulphur coke rose to 94pc of cif ARA NAR 6,000kcal/kg coal on a heat-adjusted basis, as of the last coke assessment on 15 February, compared with 74pc in late January and 68pc a year earlier. European delivered coal prices have been fluctuating but remain at multi-month lows, reaching $137.76/t as of 21 February. The small discount is a sharp reversal from late August, when coke prices fell to historic lows against coal. The delivered ARA 6.5pc sulphur coke price was just 29pc of the cost of ARA coal on 24 August, or a 71pc discount.

The shrinking discount for coke makes coal more attractive in Europe again, as typically buyers seek at least a 20pc discount in order to choose coke over coal. This includes an adjustment for coke's higher heat content of around 7,500 kcal/kg. And some market participants expect coal prices to stay low as winter seasonal demand comes to an end, but coke prices have yet to respond as Asia-Pacific demand has so far kept the market in balance with low first-quarter availability from the US Gulf.

US coke's discount was already relatively narrow in Turkey, as buyers there compare coke with Russian coal, which has been trading at a discount to other coal origins. Discounts for the 5.5pc sulphur dry basis cfr Turkey coke assessment to the Argus Turkey supra plus 6,000kcal/kg coal assessment narrowed to 10pc in early January and just 1pc in the first half of February.

Russian-origin coal is available from nearby Black and Azov Sea ports in 5,000-10,000t parcels at competitive prices, which are expected to decline further.

Buyers in Turkey have been particularly hesitant to book cargoes after the devastating earthquake at the beginning of this month, which damaged port and logistics infrastructure and hit close to some cement plants. A number of coal cargoes were redirected from Turkey to other destinations on the limited port operations and unclear cement market outlook.

Those buyers that do continue to consider coke are preferring to stick with smaller cargoes of up to 10,000t rather than full Supramaxes, which typically means they can only make purchases from Turkish refiners or from traders' stockpiles in the country.

Following a drop in the Turkey supra plus 6,000kcal/kg coal assessment as of 17 February to less than $136/t, coke may now be at a premium. But coke could regain a small discount as of this week's assessment on 22 February, even though Russian coal prices on a cfr Turkey basis were heard to decrease to the low $130s/t cfr, as bids for 5.5pc sulphur coke were heard to have fallen below $170/t cfr. A Turkish cement plant issued a tender for coke last week seeking prices at below $168-169/t cfr in the second round, which ended on 17 February. But it was understood that the firm did not conclude a trade in this tender, according to market participants.