Productivity gains flagged by US shale executives offer a welcome antidote to the doom and gloom surrounding the sector over the past year, even if they are unlikely to usher in a drilling revival.

In contrast to earlier fears that US shale output was about to fall off a cliff with the best drilling locations all but exhausted, improved well performance by the likes of Pioneer Natural Resources, ConocoPhillips and Occidental Petroleum show that a concerted efficiency drive to squeeze more out of oil-soaked rock for less is paying off. The cautious optimism that pervaded recent earnings calls may also reflect a return to the output levels implied by activity, after surging costs and bottlenecks hindered operations in 2022.

"We're not getting a lot of the congestion with supply-chain constraints and the overcrowdedness of certain basins that we saw last year," consultancy Rystad Energy senior analyst Matthew Bernstein says.

Others argue that improved performance does little to buck the long-term trend and measures to drill longer laterals, improve well designs and speed up drilling times will only delay the inevitable. Given that output from new shale wells falls rapidly after initial production, firms must continuously drill just to maintain volumes. But productivity gains signal no change in strategy, with some publicly-listed companies only marginally raising output forecasts as they remain wedded to a guiding principle of fiscal restraint to prioritise shareholder returns.

Even so, operators took turns to show off their improved scorecards from drilling new wells on recent earnings calls. Pioneer, which reshuffled drilling priorities last year following disappointing results, says average well productivity so far this year is "trending significantly above 2022". Targeting lateral wells in excess of 15,000ft (4,570m) is expected to generate internal rates of return that are 35pc above those for 10,000ft laterals.

Occidental has seen an 11pc improvement in well performance in the Delaware section of the prolific Permian basin so far this year compared with 2022. Even the majors got in on the act, with Chevron reporting record output from the Permian after revamping its drilling plans.

Behind the curve

Despite the gains, the sector will be hard-pressed to resume growth in light of a rapid steepening in decline curves, or the rates at which output falls over time, as remaining drilling acreage is getting even busier. Production from the average shale oil well doubled over the past decade, but the good times are now a distant memory, according to a new report from energy consultancy Enverus.

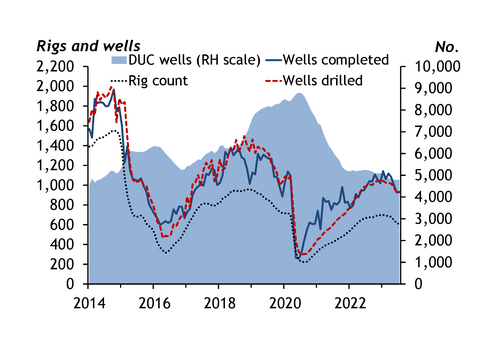

In the Permian, the average Midland basin oil production profile has steepened by 0.5 percentage points every year since 2014, while the Delaware region has steepened even more, it found. "The industry's treadmill is speeding up and this will make production growth more difficult than it was in the past," report author Dane Gregoris says. Adding to the gloom are official forecasts showing output from the Permian — which led the recovery out of the Covid-19 pandemic as other basins faltered — is poised to retreat for a third straight month in September. Production from the top shale region is set to drop by 13,000 b/d to 5.8mn b/d, which would be the lowest since February, according to US agency the EIA. Key shale production drivers are all trending downwards, EIA data show (see graph).

Improved drilling techniques such as targeting longer wells and wider spacing help at the margins but only provide short-term relief, private equity firm Kimmeridge Energy Management co-founder and managing partner Ben Dell says. "I don't think the overall trend of declining inventory and declining quality has changed in any way, shape or form," he told Argus in a recent interview.