US-origin lower-protein milling wheat could compete with French and Australian wheat for bookings into China, the latest data show. Meanwhile, the US' higher-protein crop could undercut Canadian prices, which typically dominate China's high-protein space.

China's overall wheat demand is expected to contract year on year, according to latest US Department of Agriculture (USDA) figures. But increased volumes of sprouted wheat owing to unseasonably wet weather could boost import demand from China's milling complex.

This demand has been realised in recent weeks, with China purchasing over 30 cargoes of French wheat and 10 cargoes of Australian wheat, according to market participants and recent line-up data. This is in addition to over 400,000t of US product purchased in the last two weeks, and at least five cargoes of Canadian wheat.

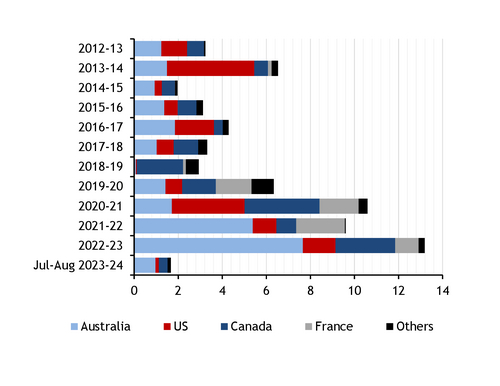

Chinese demand for US wheat has averaged 1.2mn t/yr over the past five years, according to USDA weekly export sales data. China has booked 748,000t of US wheat so far this marketing year (July-June), as of 12 October.

Official USDA forecasts peg 2023-24 US soft red winter (SRW) wheat production at 12.22mn t, as the crop has benefited from several years of favourable weather and bumper yields. This would be the US' highest SRW output since the 2014-15 marketing year, when 12.37mn t was harvested.

China purchased 4.3mn t of US wheat in 2013-14, when 15.5mn t was harvested. China's US purchases accounted for about 61pc of the country's total wheat receipts and 47pc of all SRW exported globally that year, customs data show.

China could continue purchasing US product over alternative low-protein milling wheat origins, given the abundant SRW supplies in the US. Australia was China's leading wheat supplier over the last two marketing years, but it is set to produce markedly less milling wheat in 2023-24 because of unfavourable weather conditions. Tighter wheat supply reduces the competitiveness of Australian wheat, and it has already been priced out of the market in southeast Asia, as Black Sea and South American product is priced more competitively, trading companies told Argus.

US milling wheat may be well-placed to take over some of Australia's share in China's import mix. US SRW currently prices in the mid-$250s/t fob US Gulf, equating to around $305/t cfr China, taking into account Argus-assessed Houston to Qingdao freight rates. This compares with Australian Premium White (APW) cfr China, which prices around $310/t, according to market participants.

French 11pc milling wheat remains the most competitive wheat in the market, pricing in the mid-$290s/t on the same basis. But buyers are willing to pay a premium for APW over French wheat because it carries preferential specifications, such as a higher falling number. APW and SRW have falling numbers above 300, compared with minimum 220s for French product. This means that US product may still compete in the Chinese market, despite pricing a little higher than French.

US and Canada compete for China's high-protein appetite

US-origin high-protein Hard Red Spring (HRS) wheat could price in against Canadian Western Red Spring (CWRS) 13.5pc wheat in 2023-24, according to market participants. But sentiment is mixed.

Argus assessed CWRS 13.5pc wheat fob Vancouver at around $321/t on 23 October, compared with HRS 14pc at around $335/t fob US Gulf, according to market participants. And with freight rates to China significantly lower from Vancouver than the US Gulf, the US would appear an unlikely competitor.

But a sustained lack selling by Canadian farmers means that the US may have the opportunity to absorb some market share. Minneapolis-listed futures (MGEX) rates are currently unattractive to producers in Canada, which trade on a premium basis. MGEX's front-month contract would have to rise by upwards of 20¢/bushel (¢/bu) to draw farmers back to the international market, trading firms told Argus, which would put CWRS on par with HRS on a fob basis, based on current premiums.