Refinery supply growth and weak demand have pushed ARA prices to a five-month low, write Oliver Binks and Efcharis Sgourou

Propane railcar prices declined sharply last month as they came under mounting pressure from growing refinery supplies linked to the dramatic fall in natural gas prices this year, as well as weak inland demand. But they remain well above pre-pandemic levels and, like natural gas prices, may find a price floor this summer given the uncertainties from the continuing war in Ukraine.

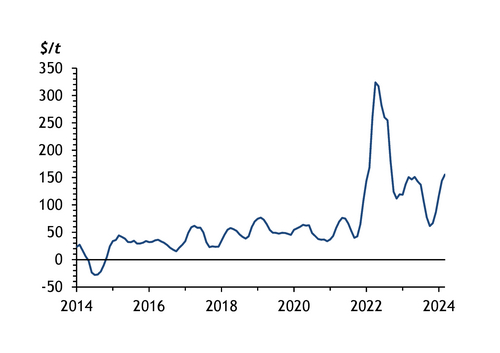

Railcar prices at the Amsterdam-Rotterdam-Antwerp (ARA) hub dropped to a five-month low of $605/t at the end of last month, while the premium to cif ARA large cargoes decreased to $79/t, also the lowest since October and compared with an average of $202/t in the first two months of this year. Yet propane railcar prices last month were still 50pc higher than the average for March over 2015-19, before the pandemic.

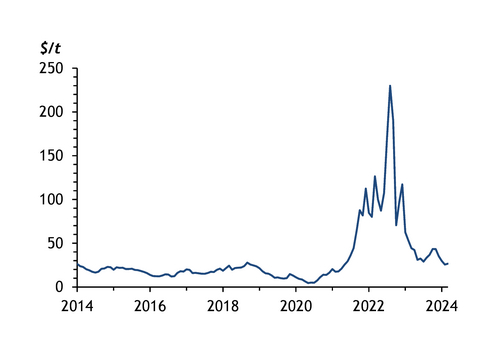

The volatility in commodity prices during the pandemic and the Russian invasion of Ukraine in 2022 have brought the relationship between LPG and natural gas into stark relief in northwest Europe, in particular for those purchasing ARA railcar cargoes.

When European benchmark TTF gas prices climbed more than thirtyfold to a staggering €304/MWh ($327/MWh) in March 2022, propane railcar prices also reached record highs above $1,500/t, pushing its premium to large cargoes to more than $730/t, as refinery supplies dwindled and demand from Poland spiked. This was because refiners switched to consuming the LPG they produced instead of costly gas, while concerned Polish buyers turned to the ARA hub fearing difficulties in securing Russian rail cargoes from the east.

TTF gas prices have fallen to almost €30/MWh this year, putting the fuel at a significant discount to LPG again and allowing refineries to make their LPG available for sale. The latest data on German refinery production of LPG reflect this, with output rising by 14pc on the year and 11pc on the month to 141,000t in January, according to the country's energy trade association EN2X.

Low gas prices have urged North Sea producers with gas processing facilities to extract and process natural gas liquids instead of leaving them in the gas stream, raising LPG supplies in Europe. Norway has exported about 350,000 t/month of LPG this year, compared with an average of 329,000 t/month in 2022.

Healthy heating

Growing supply combined with feeble heating demand this winter has allowed railcar prices to contract sharply. Gas prices may be on course to fall further this summer, keeping LPG supplies firm over the off-season. But the Ukraine war rumbles on and Europe has yet to diversify enough of its natural gas imports away from Russia to be confident of avoiding another supply shock. Russian gas transits through Ukraine to the EU could stop by the end of this year once an agreement expires, leaving Europe exposed again.

The ARA railcar market, meanwhile, will need to contend with the EU's embargo on Russian LPG starting from December. This is likely to significantly increase demand for railcars from the import hub from Poland and other eastern European countries cut off from Russian exports, which will struggle to adapt in time given import infrastructure bottlenecks, further supporting ARA railcar prices.

For now, the bearish sentiment on the railcar market is likely to persist as spring turns into summer after an exceptionally mild winter, with storages already nearly full ahead of the stockbuilding season. But the outlook could shift later this year. Demand for LPG from the petrochemical sector has picked up after run rates improved from lows last year, while Europe has been hampered by an array of logistical challenges this year, including rail strikes and maintenance in Germany. High water levels on the Rhine river have also restricted barge shipments over the past few months.