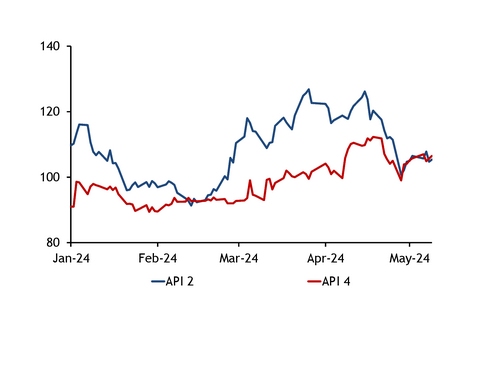

South African API 4 coal prices flipped to a premium, compared with European API 2 equivalents, prompted by steady Asian demand offsetting dampened coal generation fundamentals in Europe.

But this firmness in South African pricing could soon push European prices higher again as buyers in northwest Europe require high-calorific value (CV) cargoes, of which South Africa is a key supplier.

The South African API 4 index stood at a 98¢/t and $1.12/t premium to the European API 2 on 9 and 10 May, respectively, Argus assessments show. South African spot prices were last at a premium to API 2 on 13 February, and following this API 2 prices rose sharply, from $92.68/t to $126.58/t by the end of March following a flurry of spot activity.

High-quality NAR 6,000 kcal/kg coal that meets the standard coal trading agreements (scota) quality is used to settle the API 2 and API 4 benchmarks. European utilities sourced much of their scota coals from Russia in previous years, but following the EU ban on Russian coal imports in 2022, South Africa emerged as a key supplier.

European spot demand has fallen in recent weeks, alongside the drop in prices, but as spot activity picks up sources believe that the API 2-API 4 spread will have to widen in order for South African coal to price into Europe.

Scota-quality coals are also available from Colombia and the US, although market sources report these origins as having less availability than South Africa. This means some of the spot trades, of which there had been four for July-arrival and one for June arrival over the past two weeks, will likely have to be met with South African-origin coal.

South Africa supported by logistics

South African prices have been supported by poor rail performance into the Richards Bay Coal Terminal (RBCT) for much of the past few years.

Railings fell on 29 April-5 May to 938,000 t/week and are set to fall further because of a planned closure of the coal line on 9-18 July. Railings fell as low as 70,000t during the days of closure in 2023.

National rail carrier Transnet's (TFR) constant underperformance has been pushing up coal prices and ultimately weighs on the cost of production and dampens demand. "Because of the TFR's performance, producers never know what they can offer and when, until the coal physically turns up," a market participant said.

Nonetheless, market participants agree that a "fairly steady demand on Indian side is keeping the API 4 propped up".

India, which is typically a price-sensitive market for imported coal, is accepting higher South African pricing because of a more bullish environment, sources said. "Steel prices moving up in India is a key factor for buyers accepting a higher [API 4] price, otherwise they would be happy buying domestic coal," a trader said.

Four NAR 6,000 kcal/kg fob cargoes of 50,000t and one of 75,000t have traded at $103-105/t fob RBCT in the past 20 days.

The net forward cost of shipping NAR 6,000 kcal/kg South African coal is higher than the cif Amsterdam-Rotterdam-Antwerp (ARA) price at prevailing physical spot and forward curve prices, suggesting there is little incentive for South African producers to target the European market. The cif ARA price would need to increase to a $16.12/t premium, compared with the fob Richards Bay price, to cover prevailing Richards Bay-Rotterdam freight costs.

Supply strains, coupled with steady Asian demand, could keep "API 4 at a small premium to API 2 for a while, but it depends on how sustained it is", a broker said.

European prices weak

European cif ARA prices have fallen in the past four weeks, from $126.19/t on 16 April to $106.31/t as of Monday. South African fob Richards Bay prices have held firm at $99-$112.30/t in the same period.

As for the weakness in API 2 prices, coal generation margins in Germany remain highly unfavourable, with the month-ahead clean dark spreads for a 40pc efficient plant at minus €28.44/MWh on 14 May, keeping gas well ahead in the fuel-switching merit order.

The average API 2 premium over API 4 for March and April was $14.29/t, before narrowing towards May and finally flipping to a premium. Exporters shipped around 138,000t of South African coal to the EU in April, down from 583,000t in April last year, data from Kpler show.