US cobalt supply could be squeezed in 2025 by a combination of increasing demand, tariffs on the world's largest cobalt metal producer, China, and production issues at key suppliers.

Prices for cobalt metal in the US have remained stubbornly high compared with other global metal prices, assessed at $15.65-16.20/lb on 8 October, at a premium to European alloy grade prices at $14.75-16.25/lb and a much higher premium to European alloy grade prices at $11-12.25/lb.

Traders said they expect a squeeze on US cobalt supply next year, in the short term owing to production issues at key suppliers.

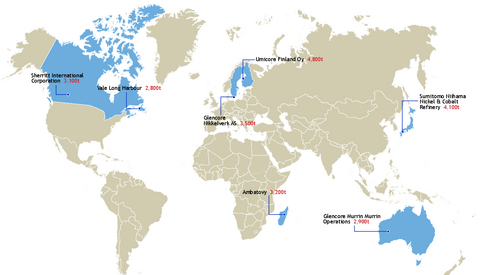

Sumitomo Metals and Mining (SMM), which produced 3,800t of cobalt metal in 2023, most of which goes towards aerospace applications in the US, is understood to be having issues with feedstock coming from its mines in the Philippines.

"Their production could be down by 500-800t next year. Massively significant for alloy market," one trader familiar with the situation said.

Madagascar-based nickel and cobalt producer Ambatovy on 27 September notified the market of a pipe accident. It is unclear how long the incident will take to fix, but one trader indicated there will be a wait for parts before full production resumes. Another trader said there would be limited impact from the incident. Ambatovy produced 3,390t of cobalt metal briquettes in 2023. Briquettes from Ambatovy, considered a chemical grade cobalt, have regularly sold into the US at $12.50-13/lb, around a $0.50-1/lb premium to the European chemical grade market.

"It does seem for the right grade in the right place, you can get better prices," one trader said.

SMM and Ambatovy are crucial suppliers to the US market, alongside Vale and Glencore Nikkelverk (see map). The US under the previous administration of President Donald Trump introduced 25pc tariffs on cobalt metal imports from China, the world's largest producer, isolating its regional market from the rest of the world at a time when Chinese cobalt has weighed on other international markets.

US demand outlook positive

Longer-term US cobalt demand is expected to rise quickly in the coming decades, driven by demand in both electric vehicles and aerospace applications.

According to a recent report by the cobalt institute and Bloomberg NEF, cobalt demand in the US could grow to 29,000t from EVs alone by 2050, up from a mere 3,000t in 2020, driven by a roll-out of higher-energy density Nickel-Manganese-Cobalt-Oxide batteries (NMC). The growth in US demand is expected to be more pronounced because of the favoured battery chemistry mix in the US, something that is not reflected in China or Europe, where lithium-iron-phosphate (LFP) and high manganese batteries are expected to be key.

Despite the rise in usage of non-cobalt batteries, Argus expects the global market share for cobalt containing battery chemistries to be 24pc by 2034.

Industrial cobalt demand is also likely to rise, especially in the aerospace sector. Cobalt demand from the superalloy sector, much of which is based in the US, is expected to grow to around 38,000t by 2035 and 55,000t by 2050, up from just 15,000t in 2020. Of that, aerospace and defence demand is due to make up the vast majority, at 28,000t in 2035 and 42,000t by 2050, a large increase on the estimated 5,000t in 2020.