Cuts to Mideast Gulf official formula prices look to have buoyed European interest in term supplies from Saudi Arabia and Iraq for 2025.

Five refiners in northwest Europe and the Mediterranean region tell Argus that they plan to keep their annual term supplies from Saudi Arabia and/or Iraq unchanged next year. But one refiner is mulling the possibility of becoming a buyer of Saudi crude. Annual term supplies are typically negotiated in October-November before January official formula prices are issued in December.

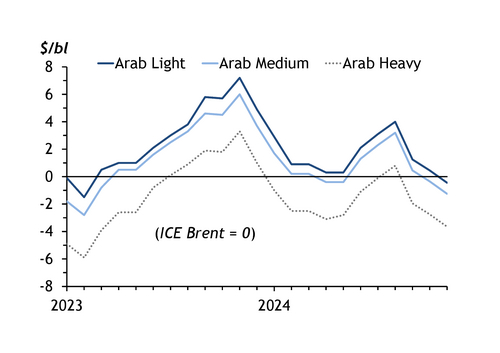

Three months of consecutive reductions to European formula prices amount to more than $4/bl of cuts on average for Saudi grades, and nearly $3/bl for Iraqi Basrah exports. Saudi Aramco and Iraqi state-run marketer Somo may have opted to reduce prices to maintain market share in Europe following the restoration of a large tranche of Libyan output in early October, which has left regional buyers with plenty of choice at a time of unsupportive refining margins.

The reductions have left Saudi Arab Medium looking more competitive relative to spot Norwegian medium sour Johan Sverdrup. Aramco set the November formula price of Arab Medium to northwest Europe at a $1.25/bl discount to Ice Brent, its widest since February 2023. Johan Sverdrup is currently assessed at a 70¢/bl discount to benchmark North Sea Dated, which averaged a 91¢/bl premium to Ice Brent in January-September this year, underscoring the competitiveness of Saudi supplies.

Further cuts to formula prices could partly depend on whether Opec+ proceeds with its plan to unwind 2.2mn b/d of output cuts from December. The group has stressed that the plan could change depending on market conditions.

Adapting to risk

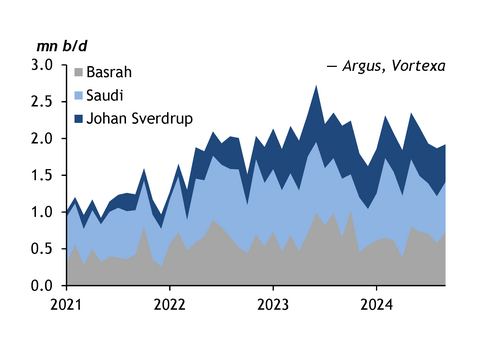

Tensions between Israel and Iran have the potential to disrupt Mideast Gulf supplies, although the market has adapted to other geopolitical risks in recent years. Attacks by Yemen's Houthi rebels on tankers in the Red Sea since November have sharply cut westbound traffic through the Suez Canal. But Europe-bound supplies from Saudi Arabia and Iraq have held up relatively well. This may be because EU sanctions on Russia and the closure of the Iraq-Turkey pipeline have largely removed competing Russian Urals and Iraqi Kirkuk from Europe.

Saudi Arabia can load crude at the port of Yanbu in the northern part of the Red Sea, allowing tankers to avoid the high risk areas of the Mideast Gulf, the Gulf of Aden and the southern part of the Red Sea. Yanbu loadings to Ain Sukhna in Egypt more than doubled on the year to almost 710,000 b/d in January-September, according to oil analytics firm Vortexa. Supplies from Ain Sukhna can move through the Sumed pipeline to Sidi Kerir on the Mediterranean coast, from where they can reach European markets in days.

European receipts of Saudi crude were close to 735,000 b/d in January-September, 7pc down on the same period in 2023, most likely because of the country's 1mn b/d output cut since July 2023, which has reduced exports. But they were 8pc up on the same period in 2022.

Iraqi supply is more at risk from an escalation in the conflict between Israel and Iran, as Basrah crude can only be exported through the Strait of Hormuz. Somo also does not have the Saudi option of avoiding the dangerous parts of the Red Sea, meaning that Europe-bound tankers carrying Basrah crude are increasingly taking the longer route around southern Africa. This looks to have pressured demand. Argus tracking shows Basrah exports to Europe at around 665,000 b/d in January-September, a 9pc drop on the year, even as total loadings rose. Exports to Europe this year have been broadly steady on the same period in 2022.