Risk reduction contracts held at the Dutch TTF gas trading point on the Intercontinental Exchange (Ice) soared to a near record high in the week ending 24 January, suggesting significant hedging activity.

Firms take on risk reduction contracts mostly for hedging purposes — they offset a physical position with a paper position so as to reduce exposure to price fluctuations. When firms inject gas into storage, they might for example open a risk reduction contract on paper to offset this position in the future.

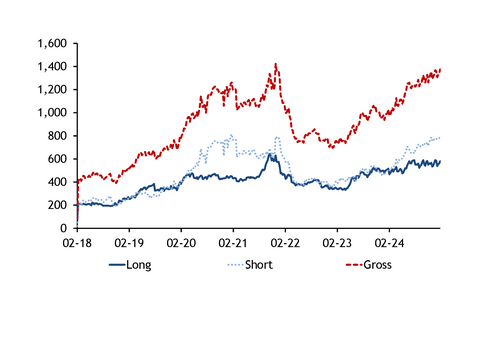

The gross amount of gas that commercial undertakings hold under long and short risk reduction contracts combined reached its second highest since at least 2018 at 1.38PWh in the week ending 24 January, the most recent data from Ice (see risk reduction graph) show. Firms increased their long positions by 19TWh week on week to 581TWh, and their short positions by 13TWh to 794TWh. After netting the two off, commercial undertakings hold a net short position of around 214TWh of risk reduction contracts, down from a recent peak of 228TWh in the week ending 3 January.

Higher LNG deliveries to Europe in recent weeks may have driven some of the interest in risk reduction contracts, given that importers need to hedge ahead of time in order to lock in margins. TTF prices have increased enough in recent weeks to firmly close the arbitrage between the Atlantic and Pacific basins, attracting more LNG cargoes to Europe. European LNG imports soared in January to their highest for any month since April 2023.

The TTF summer 2025 contract's growing premium to the winter 2025-26 market may have additionally boosted interest in risk reduction contracts. The spread widened sharply after Germany's THE announced a consultation for a new kind of storage tender that would subsidise injections if seasonal spreads stay inverted, with many traders seeing this as a signal that German storage sites will be refilled, regardless of commercial incentives. The TTF summer 2025-winter 2025-26 spread jumped to +€4/MWh on 21 January, the day of THE's announcement, from +€2.73/MWh a day earlier, and widened further to as high as +€6.39/MWh by 30 January.

In terms of total net positions across all contract types, investment funds held a net long of nearly 278TWh in the week ending 24 January, the highest since late November. At the same time, investment and credit firms held their highest net short position since October 2021 at 245TWh. Commercial undertakings held a net total short position of 33TWh (see net positions graph).