Adds comments from market participants

France's EdF has detected possible defects in piping at the 1.5GW Civaux 2 reactor, according to nuclear safety authority ASNR.

Tests revealed two "signs" — typically echoes from ultrasound testing — that could indicate a defect, ASNR said.

The tests — part of its strategy to treat stress corrosion — are continuing. ASNR said there is no confirmation at this point that the potential faults are evidence of stress corrosion.

Stress corrosion is a process by which mechanical stress in the presence of certain chemicals leads to fissures in pipework. The French reactor fleet was heavily affected by this condition in 2021-23, with around a third of the fleet taken off line for inspections and repairs.

Civaux 2 is an N4 reactor — there are two at Civaux and another two at Chooz. They were the last reactors built before Flamanville 3, entering service in 2000-02, and the most powerful built in France up to that time.

Civaux 2 has been off line for maintenance since 5 April and is scheduled to return on 31 July. It was being defuelled for maintenance and inspection and tests, before having a third of the fuel switched out.

The 1.5GW Civaux 1 was the first reactor where stress corrosion faults were discovered, in August 2021. Tests at the other three N4 models in the following months confirmed stress corrosion at all of them. The N4 models — along with a dozen 1.3GW P4 reactors — are particularly vulnerable to stress corrosion, EdF's nuclear and thermic director, Cedric Lewandowski, told a parliamentary commission in 2022.

The French power curve rose sharply on Wednesday morning following reports of the possible defects on Tuesday evening. The front-year contract jumped from an assessment of €62.30/MWh yesterday to over €68/MWh in the morning, before falling to around €66/MWh by mid-afternoon.

Market participants were divided in their assessment of the actual impact of the news. One suggested that with only minimal information officially confirmed, the price movement may turn out to have been an overreaction.

But another suggested the spectre of a return of stress corrosion heightened risk, justifying the premium that French contracts have gained. And a third said that the size of the potential consequences meant the price changes could prove long-lasting.

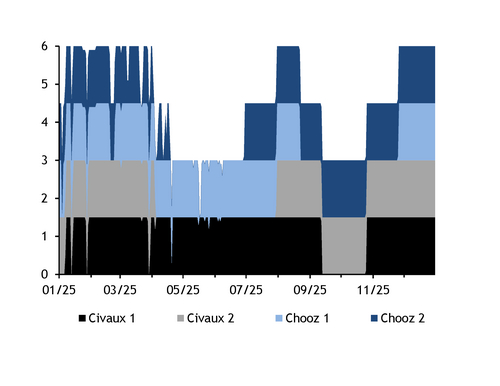

Civaux 2 is still scheduled as of Wednesday evening to return to service on 30 July. Availability from the four N4 reactors is scheduled at 3GW throughout most of this month, rising to 4.5GW from the beginning of July and then to 6GW for the first three weeks of August, before falling again to 3GW from mid-September (see graph). Chooz 2 has been unavailable since mid-April for economic reasons, having halted output on 18 April to save fuel for higher demand periods, EdF said.