The European Commission today suspended Pakistan's Generalised Scheme of Preferences Plus (GSP+) status for imports of ethanol.

The removal is effective from today, 20 June.

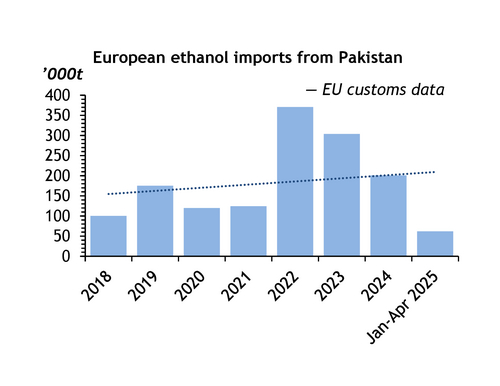

A request was lodged in May last year by France, Germany, Spain, Italy, Hungary and Poland, who sought to activate Article 30 of the GSP Regulation, arguing that ethanol coming from Pakistan since 2022 has "caused a serious disturbance to the Union ethanol market".

Under Article 30, the commission can "adopt an implementing act in order to suspend the preferential arrangement in respect of the products concerned".

Pakistan was granted GSP+ status in 2014, and this expired at the end of 2023. The status was temporarily extended until 2027.

The GSP+ grants reduced-tariff or tariff-free access to the EU for vulnerable low- and lower- to middle-income countries that, according to the EU, "implement 27 international conventions related to human rights, labour rights, protection of the environment and good governance". It fully removes custom duties on two-thirds of the bloc's tariff lines in Pakistan's case, including ethanol.

Pakistan is a major supplier of industrial-grade ethanol to Europe, but it does not export fuel-grade ethanol. According to market participants, this is because production facilities in the country lack sustainability certifications such as the International Sustainability and Carbon Certification (ISCC) that are required for biofuels to qualify under the EU Renewable Energy Directive (RED) targets.

Fuel-grade ethanol was not included in the bloc's measures.

Several Pakistani market participants were hopeful the GSP+ status will remain in place, which has continued to support ethanol exports from the country to the EU (see table). But uncertainty has weighed on demand from Europe recently, suppliers said.

A participant told Argus that Pakistani sellers may look to offer more into Africa to soften the drop in demand.

Some European suppliers anticipated this outcome, and have already stopped importing from Pakistan.

European renewable ethanol association ePure expressed concern about the decision to exclude fuel ethanol from the scope of the measures, noting this could open the door to unintended loopholes and weaken the overall effect of the safeguard efforts.