Algiers aims to build further on its successful return to upstream licensing, writes Aydin Calik

Algeria revealed the results of its first upstream licensing round in over a decade this week. The outcome is encouraging with five out of six blocks on offer awarded. Key winners include Italy's Eni, France's TotalEnergies and China's Sinopec, all of which are already present in the country. But Qatar's state-owned QatarEnergy (QE) marks a notable new entry (see table).

The licensing round marks a huge milestone in the country's efforts to cultivate investment in its oil and gas sector, and is the first under an oil law that came into force in 2021. Mourad Beldjehem, president of upstream regulator Alnaft, tells Argus that the awards will lead to around $1bn of mainly exploration investments. Development spending would bring in much more. Algeria needs it.

State-owned Sonatrach wants to capitalise on Europe's energy security challenges and replace some of the lost gas flows from Russia following the latter's invasion of Ukraine in 2022. But this is a work in progress. Algeria's gas exports have been squeezed in recent years by natural decline at producing fields and strong domestic consumption. Gas output and exports fell by 7pc to 98.3bn m³ and 48.5bn m³, respectively, in 2024.

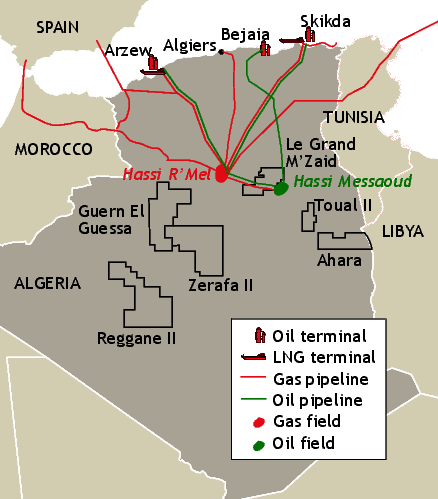

Of the six onshore blocks on offer, the only one that was left unawarded was Grand M'Zaid, which contains a producing oil field. A source told Argus there was a bid for this block but it was not awarded because of a procedural issue. The other five contain undeveloped gas discoveries and lie close to existing facilities, potentially allowing tie-ins that could cut development costs and time.

For example, Eni and Thai firm PTTEP's new Reggane II block is located close to the Touat gas field in the Ahnet basin. TotalEnergies and QE's Ahara block is within reach of the French major's TFT gas production facilities that lie in the Illizi basin. Beldjehem says the awards could unlock 20bn m³/yr of new gas production in the medium term — equal to about 40pc of current exports — with first output potentially on line within three years. And there could be more, with exploration drilling expected to start next year.

The results are far better than the previous licensing round in 2014, which saw only four of 31 blocks awarded. But there is room for improvement. Ultimately, only seven bids came in for five blocks, despite 37 companies officially expressing interest. "I know where the problem was and we will fix that for the next one. We had a lot of lessons learned from this one," Beldjehem says. Another onshore bidding round is planned for the fourth quarter, and will offer 4-6 blocks. This will also be gas focused. "That is the demand today," Beldjehem adds. After this, three more rounds are planned each year up to 2028.

Competitive advantage

The time is ripe for an investment boom. European firms are refocusing on their traditional oil and gas businesses as climate-change-related shareholder concerns take a back seat. Algeria faces some tough regional competition, however, particularly from Libya, Egypt and the wider eastern Mediterranean. But its existing gas export potential into Europe, strong resource base and political stability should give it a significant competitive advantage over its neighbours.

The licensing rounds are only one part of the country's plan to boost investment. Algeria has signed more than $8bn worth of bilateral upstream contracts with companies such as Eni, TotalEnergies and Occidental since 2021. But it must do more. Sonatrach is holding talks with several companies. The most important of those are with US firms ExxonMobil and Chevron over their potential entry into the country to explore its shale potential. If these contracts go through, they could lead to a substantial upgrade to Algeria's production outlook.

| Algeria licensing round results | |||

| Block | Bids | Winners | Block type |

| Toual II | 1 | Zangas-Filada | Gas |

| Ahara | 1 | TotalEnergies-QatarEnergy | Wet Gas |

| Zerafa II | 3 | ZPEC | Gas |

| Guern El Guessa II | 1 | Sinopec | Gas |

| Reggane II | 1 | Eni-PTTEP | Gas |

| Grand M'Zaid | 0 | Not awarded | Oil |

| SOURCE: ALNAFT. | |||