The risk of supply disruptions from the Middle East has prompted the government decision, writes Reina Maeda

The Japanese government says it will maintain LPG stockpile obligations out to 2030 despite flagging domestic consumption because of the risk of supply disruptions from the Middle East.

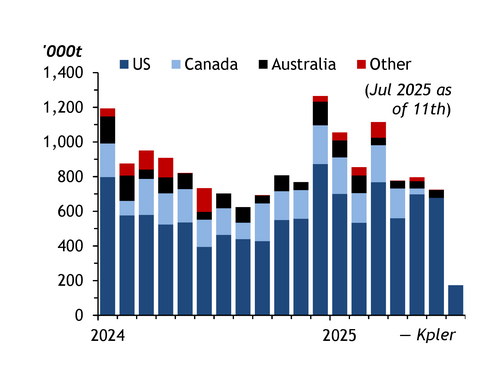

Japan no longer relies on imports from the Middle East, with the share coming from the region now down at around 10pc — most imports now come from mainly the US and to a lesser degree Canada and Australia. But Middle Eastern exports supply around 30pc of the global market, and the geopolitical risks in the region are high, meaning disruptions will have a corollary impact on other origins, a subcommittee of trade and industry ministry Meti says. Japan's priority is to secure resources, especially in light of the Israel-Iran conflict, it says. So the country will continue to store 1.4mn t of LPG, or 50 days of imports, under state-owned stockpiles, and a further 1.1mn t, or 40 days of imports, under private-sector stockpiles until the end of fiscal year 2029-30 in March.

The threat of Middle Eastern exports being disrupted is more pressing given that demand from the world's largest importers, China and India, continues to grow, according to the subcommittee. Around 99pc of the 21.4mn t India imported in 2024 came from the Middle East, while 42pc of China's 34.6mn t came from the region, Kpler data show. Japan meanwhile has shifted its dependence on imports from the Mideast Gulf to largely the US over the past 10 years. The country took in around 10mn t in 2024-25, of which only 371,100t, or 3.7pc, came from Saudi Arabia, Qatar, Kuwait and the UAE, data from the finance ministry show, while 6.3mn t, or 64pc, came from the US. This compared with the 7.8mn t it imported from the Middle East in 2014-15, about 72pc of the 11mn t total, while only 1.9mn t was sourced from the US, the data show.

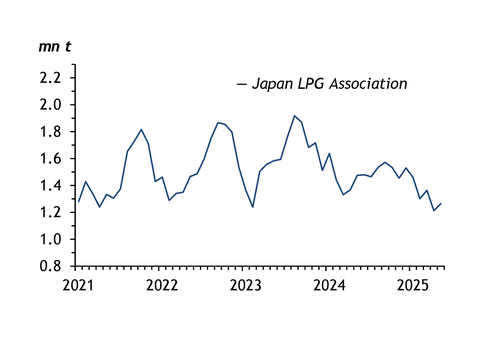

Japan has separate state-owned and private-sector stockpiling programmes, the former led by energy agency Jogmec, which owns five import terminals. Jogmec has filled its terminals since 2017 — storing around 250,000t at Nanao in Ishikawa, 200,000t at Fukushima in Nagasaki, 200,000t at Kamisu in Ibaraki, 450,000t at Namikata in Ehime, and 400,000t at Kurashiki in Okayama. Private-sector stockpiles at various terminals operated by the country's importers stood at 1.1mn t as of May, according to the Japan LPG Association (JLPGA).

Playing it too safe?

Some Japanese LPG industry participants have argued that the private-sector stockpile obligation should be lower. The domestic sector is undergoing consolidation as a result of operating pressures stemming from a long-term decline in demand, which they attribute to energy efficiency gains and a shrinking rural population. Meti also forecasts domestic consumption to continue declining to around 11.4mn t/yr by 2029-30 from closer to 12mn t/yr now, even after relaxing a target to transition city gas to 100pc renewables by 2030.

The cost of maintaining storage tanks has become an increasing burden for importers, market participants say. And the need to use storage tanks at facilities for the obligated stockpiles restricts importers' ability to flexibly trade supplies. Japanese LPG importers postponed purchases in early April because of short-term supply tightness caused by China's retaliatory tariffs on US imports. Further industry consolidation could limit the number of available tanks, making it more difficult for such manoeuvres if mandatory levels are kept the same, they say.

Government subsidies are not available to support the private-sector importers' stockpile obligation, but they do receive support in the form of low-interest loans from Jogmec. Most importers are applying for the loans and have been using them, Meti has said. This is a probable response to the higher fees for maintaining storage tanks, but it is unclear if this will be sufficient to prevent closures.