The northwest European used cooking oil-based hydrotreated vegetable oil (HVO) Class II premium to gasoil firmed to a fresh nine-month high at the beginning of September as demand strengthened.

HVO is a drop-in fuel virtually chemically identical to fossil diesel.

The recent price gains were driven by stronger demand in Europe, from obligated parties rushing to meet member states' respective biofuel blending mandates, guided by the EU Renewable Energy Directive (RED), before the year-end and before prices rise further.

Increased consumption has also contributed to tighter supplies in Europe. And planned maintenance closures at many European and Chinese facilities during the fourth quarter may continue to support values into 2026.

Demand from the Netherlands is leading the way, according to market participants, as some obligated parties may look to carry-over Dutch renewable fuel tickets (HBEs) into next year. HBEs are tradeable credits primarily generated by supplying biofuels into the road fuel market and are used to show that obligated parties met their mandates for the use of renewable energy in transport. Obligated parties can carry over up to 10pc of their HBEs into next year, although a proposed change to the Dutch mandate for next year would convert HBE carry-over into a new type of ticket called an ERE.

SAF takes the lead

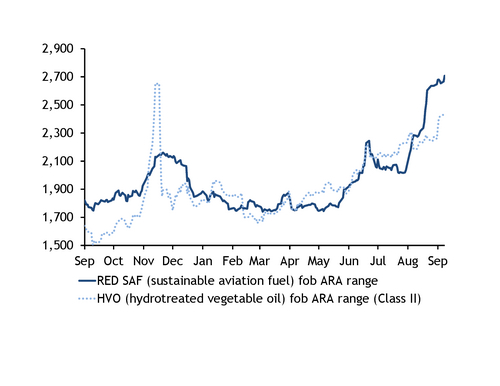

HVO Class II premiums have been on the rise since February, and have largely held at a premium to hydrotreated esters and fatty acids (HEFA) sustainable paraffinic kerosene (SPK) this year.

HEFA-SPK is the most widely available type of sustainable aviation fuel (SAF). HVO Class II and HEFA-SPK are both made from used cooking oil via hydrotreatment, but HVO requires fewer processing steps, making it typically cheaper to produce.

The HVO premium over SAF has incentivised many producers to boost the ratio of the HVO output compared with SAF this year.

But the SAF market has started to feel the effect of the switch with prompt SAF supply dwindling.

Adding to the pressure, SPK exports from China to Europe have not increased as much as many participants had expected. Several Chinese plants came online this year and expected to get export licences from the Beijing government this summer, but they are still waiting. Only Jiaao Enprotech has a licence to export SAF for now.

Because of this, HEFA-SPK supply in Europe is insufficient to meet current demand, and the fuel's premium over gasoil has been holding at a 19-month high since late August. The HEFA-SPK fob ARA premium over Class II HVO peaked at around $395/t on 26 August, the widest premium since July last year.

As a result, some participants suggested that HVO offers may be tracking gains in HEFA-SPK, and HVO bids may need to be competitive enough to incentivise producers to continue to maximise HVO output.

The gain in the Class II premium caused production margins for the variant to rise on the month, with the sales price increasing to around $2,613/t on 9 September. This is compared with around $3,679/t in the case of HEFA-SPK, according to Argus calculations.

Used cooking oil prices did not firm to the same extent throughout the month, as some in the market expect demand to decrease during the fourth quarter, with several producers undergoing planned maintenance.