The Democratic Republic of Congo's (DRC) announced export quotas, to be implemented next month, are expected to tighten the cobalt market in the coming months towards balance, but would not cause an immediate spike in prices, according to market participants.

DRC market regulator Arecoms announced on 21 September that it will end the suspension on 16 October and ration exports at 3,625t in October and 7,250 t/month in November–December, then 96,600 t/yr in 2026–27 split between an 87,000t base and a 9,600t strategic pool under its discretion — reviewed quarterly and with exclusions for certain operators. The design gives officials room to tighten or ease without lifting the cap, traders said .

Consensus among traders appears to be that the quota will be enough to cover chemical demand for sulphate and chloride, but force down excess Chinese metal output — the segment widely blamed for the overhang and falling prices. Implementation should support an incremental price increase rather than a squeeze in the market.

Others add that cobalt-containing nickel mixed hydroxide precipitate (MHP) and scrap cobalt could increase marginally, but cannot fully plug the gap, particularly for chloride where nickel contamination is problematic.

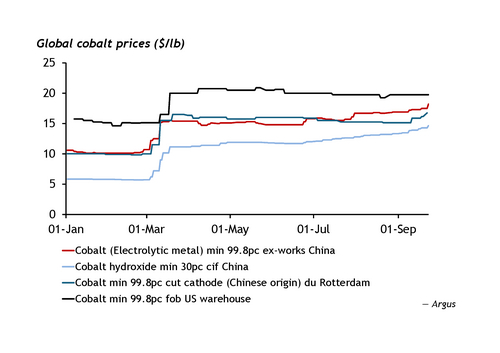

Several market participants floated prices through the high $16s/low $17s in the near term, with $20/lb as a plausible waypoint into the first quarter, provided enforcement holds and logistics push first-quota cargoes into January.

"I think standard grade could move to $20/lb in the first quarter… but not overnight", one trader said.

"It doesn't drive across to 20 today. It means you're slowly going to rally for the rest of the year," another trader said.

Indonesian MHP's importance grows

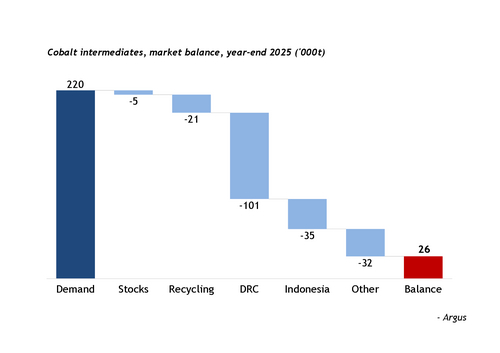

Despite consensus on prices, the precise market balance (see graph) next year is contested, in part owing to the impact of Indonesian material, which has ramped up in recent years.

According to Argus estimates, DRC exported 199,000t of cobalt contained in hydroxide last year, meaning that at 96,600 t/yr quota in 2026-27 equates to 49pc of last year's shipments, or 44pc if only the 87,000t base is effectively available.

But some participants reported export volumes to Argus of 169,000t last year, making the quota appear more loose at around 50–60pc of last year's volumes; others reported export tallies nearer 220,000t, implying 40pc.

This in turn affects forecasts of a shortage in supply.

One trader reported a 45,000–65,000t supply deficit next year if quotas are strictly enforced, a portion of the strategic pool is withheld and incremental state buying soaks up units.

Another trader calculated a shortfall of around 30,000t by the second half of 2026 if two offsets scale: first, dissolving metal into chemicals to ease the hydroxide pinch; second, additional MHP into China at about 35,000t this year, rising to about 50,000t next year led by rising imports from Indonesia and Papua New Guinea.

Even then, participants stress that on a cobalt unit basis, MHP contribution is modest, and it cannot fully substitute DRC hydroxide in chloride routes because of nickel contamination thresholds — meaning that these offsets trim rather than erase the gap.

What most agree on is timing risk. Quota paperwork and freight make December tight, with little relief before January.

From 'reprieve' to managed scarcity

After months of export ban extensions, news of a quota system at whatever percentage marks a shift from February's "temporary reprieve" phase that relocated stocks rather than fixed fundamentals. Prices quickly spiked on exchanges, while the physical market stayed cautious pending quota mechanics .

Customs later recorded the expected collapse in hydroxide imports and refinery cutbacks, reinforcing the case that any restart under quotas would tighten before it eases. Last week's update flagged that even with a restart, first arrivals were likely no sooner than January — a view echoed today.

Few expect the regime to sit unchanged for two years; most anticipate quarterly recalibration once prices bite and offshore stocks thin. But compared with past episodes, contacts see this as a more institutionalised framework — with a discretionary strategic pool, state purchase options for excess stock, and the ability to withdraw or reassign quotas — all of which nudge the market toward administered scarcity rather than a binary ban or no ban cycle .

And several factors still cloud the extent to which prices will rise, such as the bullish effect of electronics led LCO demand, which is firming into year-end, or the extent to which refiners dissolve metal into chemicals if hydroxide stays tight could prove bearish for metal in the short to medium term.