The world's largest autogas fleet is facing multiple challenges with prices rising this year, writes Efcharis Sgourou

Turkey's demand is set to decline in 2025 for a second consecutive year as economic headwinds weigh on the country's autogas sales, delegates heard at the Argus LPG Conference in Istanbul over 16-17 October.

Domestic LPG distributor Aygaz expects LPG imports to decline by 4-5pc this year owing to an erosion in household purchasing power that is dragging on consumption. But the market should recover in the next few years, with autogas remaining the bedrock of domestic consumption given its persisting cost advantage over gasoline, Aygaz supply chain director Elifcan Yazgan told delegates.

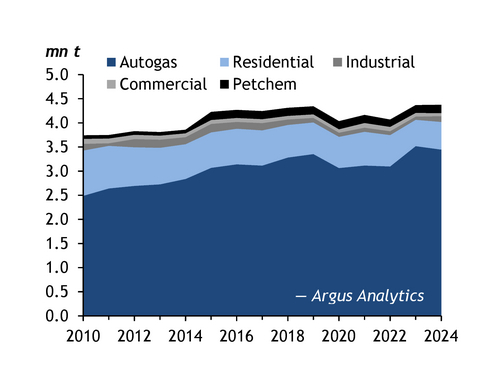

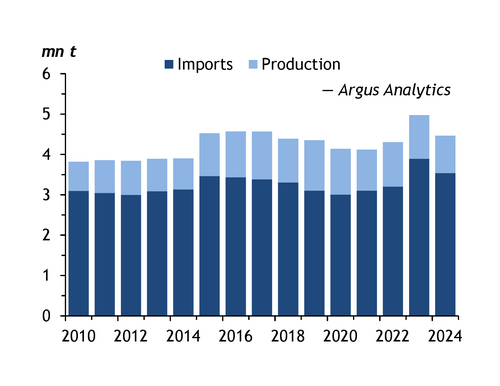

Turkey consumes about 4.1mn t/yr of LPG, of which more than 3.5mn t/yr was imported in 2024, according to Aygaz. The country's autogas consumers, mainly consisting of a middle-income demographic, account for just over 80pc of domestic consumption. Autogas use stood at about 3.4mn t in 2024, down from 3.5mn t in 2023, Argus Analytics data show.

The country has 5.2mn autogas cars representing about 35pc of the total vehicle fleet, Aygaz says, making it the world's largest autogas market based on fleet numbers — Russian autogas sales slightly exceeded Turkey's last year. But the sector's resilience is being tested by economic difficulties. Inflation has remained stubbornly high throughout 2025, jumping by more than 30pc this year despite interest rate hikes by the country's central bank. The lira has also fallen to record lows against the US dollar, lifting fuel import costs and squeezing consumers already burdened by rising expenses. Autogas prices have climbed steadily this year but have largely retained their significant price advantage over gasoline and diesel, offering savings of about 40-45pc on an energy equivalent basis.

Gasoline prices in Turkey in 2019, prior to the crash in the lira's value and the impact of post-pandemic inflation, stood at about TL6.8/litre, equivalent to $1.11/l at the time. They are now at about TL52.3/l. Diesel prices climbed to TL55.4/l from TL6.4/l over the same timeframe, while autogas jumped to TL27.7/l, still putting it about 59¢/l lower than gasoline.

Although autogas use eased in 2024 and may do so again this year, it is still on a robust upward trajectory viewed over a longer timespan (seegraph). The country's residential, industrial and commercial demand is conversely continuing to contract over the long term owing to natural gas pipeline rollouts. Cylinder LPG sales have dropped by 73pc to about 573,000 t/yr since 2000, according to Turkish distributor Milangaz's commercial director, Can Toydemir. Bulk LPG sales to mainly the industrial and commercial sectors have fallen by an even greater degree — by 89pc to 120,000 t/yr, he said. Autogas use by contrast has almost tripled to about 3.45mn t/yr from 1.28mn t/yr, Milangaz data show. "Cylinder consumption has been falling about 5pc/yr as stronger natural gas grid penetration displaces bottled and bulk LPG use, and this trend will persist," Toydemir said.

Grid unlocked

Turkish gas grid development over the past 20 years has brought pipeline access to most urban areas, while government policies have continued to support the adoption of natural gas for household and industrial usage. As a result, LPG's role in these sectors has slowly diminished while retaining a foothold in off-grid areas. But the non-autogas LPG sector remains strategically important for Turkey. When natural gas prices surged in 2023 following Russia's invasion of Ukraine, many industrial and commercial users temporarily switched to LPG, supporting record import volumes that year and underscoring LPG's value as a back-up alternative.

The LPG market is expected to regain momentum over the longer term, anchored by autogas, delegates heard, with residential, industrial and commercial use expected to continue to wane.

| Turkish autogas market | ||

| 2023 | 2024 | |

| Demand mn t | 3.5 | 3.4 |

| Vehicle fleet mn | 4.9 | 4.9 |

| Refill sites | 10,060 | 10,061 |

| — Argus, WLGA | ||