Romanian gas demand is expected to increase next year as a result of new gas-fired power capacity starting up, although the extent of demand growth could be limited by project delays.

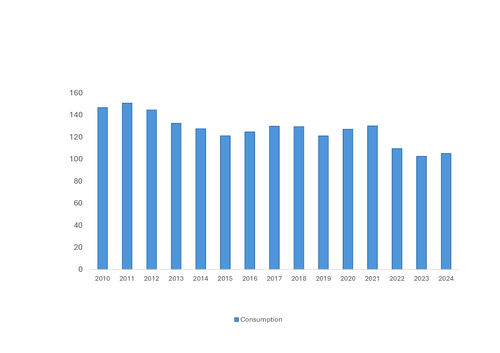

Romanian gas consumption averaged 257 GWh/d on 1 January-14 December, below full-year 2024 demand of 283 GWh/d, and only slightly above a historic low of 256 GWh/d in 2023 (see graph). Romanian industrial users and power generation have accounted for 24pc of gas consumption so far this year, with 76pc coming from residential demand.

Romanian gas demand had been increasing until the energy crisis of 2022, supported by growing household grid connections and coal-to-gas switching in power generation. Romania's ability to become net exporter following the commissioning of the Black Sea Neptun Deep field will depend on where domestic consumption stabilises. This will determined by the buildout and utilisation of gas-fired power plants and industrial gas consumption.

Romania plans to replace coal-fired power plants with new gas-fired combined-cycle gas turbine (CCGT) plants and cogeneration units, which may support domestic gas needs in the next few years. Romanian gas-fired output has totalled 8.9TWh this year, accounting for 20pc of power generation, down from 10.3TWh for 2024. The country planned to decommission 3,780MW of coal and lignite-fired generation capacity by the end of 2025, before phasing out these fuels from the power mix by 2032. But Romania has renegotiated with the EU to postpone the coal phase-out until the end of 2029 because of slow progress building gas-fired plants. This will ensure the security of the domestic energy system and guarantee the country avoids blackouts during the winter, energy minister Bogdan Ivan said. Under the new schedule, Romania will have 900MW of lignite-fired units operational until the end of 2029. Coal has made up 14pc of the generation mix so far this year, unchanged from a year earlier.

Romania has not added any thermal capacity in recent years, but several CCGT units are expected to be commissioned next year. The start-up of the long-awaited 430MW Iernut CCGT — previously expected at the end of this year — has been pushed back to the second quarter of 2026. The 1.75GW Mintia CCGT is due to come on line by the end of next year, while a 53MW gas-fired combined heat and power plant in Constanta, southeast Romania, is scheduled to begin operations by June 2026. An 850MW CCGT plant is also planned at Isalnita. These projects could boost combined power-sector gas demand by over 4bn m³/yr in 2026, Argus estimates, assuming they are running at maximum capacity. But the Isalnita project may struggle to come on line next year, while the other projects could experience further delays.

And Romania's reliance on gas for power generation is likely to increase further in the coming years because a 700MW unit at the Cernavoda nuclear plant is scheduled to shut down for modernisation in 2027-29.

But Romania has also been expanding renewable capacity, which could limit uptake of gas in power generation. The country added 1.2GW of solar capacity over the first 11 months of 2025, up from 303MW in 2024. Total solar capacity stood just above 3GW at the end of November, while solar output has averaged 327MW so far this year, up by 75MW from 2024. But just 41MW of wind capacity has been added so far this year, down from 69MW in 2024.

Azomures' gas demand could rise next year

Fertiliser producer Azomures, Romania's largest gas consumer, restarted part of its production in July after 11 months of downtime, and the firm may restart nitrogen production next year in response to an anticipated increase in import prices caused by the EU's Carbon Border Adjustment Mechanism and lower natural gas costs, according to a market participant.

Romanian industrial output fell by 0.5pc year on year in January-October, the national statistics office said on Monday. The European Commission expects Romanian GDP to grow by 0.7pc this year, 1.1pc in 2026 and 2.1pc in 2027, it said on 17 November. This could support industrial gas demand growth in the coming years.

Domestic onshore production is projected to decline towards 2035, but output from Neptun Deep — owned 50:50 by domestic firm Romgaz and Austrian OMV — is scheduled to start in 2027. The project aims to increase the country's gas output to 18bn-20bn m³/yr from 8bn-10bn m³/yr at present, bringing "Romania full import independence and even net-export status from 2027", the government has said.

Romgaz has received government approval to assess a potential acquisition of Azomures. Romgaz could provide access to reliable supply, potentially changing the market position of the chemical producer. Assuming Azomures operates at full capacity, Romanian gas consumption could rise by 1.2bn m³/yr, according to grid operator Transgaz (see table).

| Sources of Romanian gas demand growth | bn m³/yr |

| Project | Demand |

| 1.75GW Mintia power plant | 2.5 |

| 850MW Isalnita CCGT | 0.8 |

| 475MW Turceni CCGT | 0.8 |

| 430MW Iernut CCGT | 1.0 |

| Azomures fertiliser plant | 1.2 |

| Piatra-Neamt chemical plant | 0.8 |

| Household sector | 3.0* |

| * target | — Transgaz |