US thermal coal markets are ending 2025 on a stronger footing than when they started the year, with producers expressing cautious optimism about 2026.

Prices for most US thermal coal were at their highest levels since April-May 2023 in September and October. While steam coal prices have slipped in more recent weeks, they remain well-above year-earlier levels.

US coal markets began to recover near the end of 2024, in response to a blast of colder-than-expected weather and higher natural gas prices. Coal-fired generation in at least some of the US continued to be above expectations through the third quarter of this year. This unanticipated boost offset lackluster seaborne coal pricing, leading US coal producers to focus their sales on US markets.

Some producers expect to continue to favor domestic shipments over international markets in the coming year, given that US customers continue to be willing to pay more than international buyers.

"We're still in negotiations for additional business next year," Core Natural Resources chief financial officer Mitesh Thakkar said on 6 November. "We certainly could increase some more volumes and get them exported. But I would say domestic is going to be year-on-year improved."

The US Energy Information Administration (EIA) is expecting coal-fired generation to decrease next year largely because of continued power plant retirements. But generation may still be higher than in 2024.

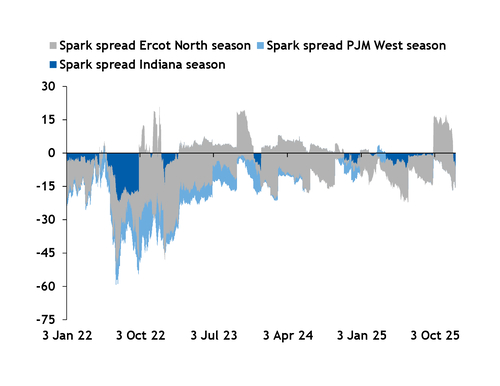

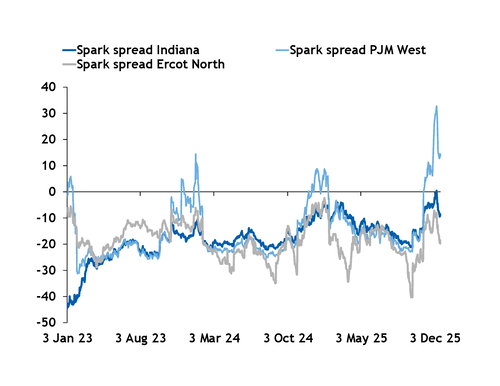

Some market fundamentals suggest generators could run remaining coal units at relatively elevated rates during peak demand seasons. Profit margins for running coal units in December, January and the first quarter of 2026 have been running higher than year earlier levels. In some cases, coal-fired generation also has been more profitable than power dispatch from some natural gas plants.

For example, in the first 12 days of December, Argus assessed the peak day-ahead spark spread for 10,000 Btu/kWh coal units at the Indiana power hub — a reference point for central portions of the Midcontinent Independent System Operator — at an average of $27.44/MWh, while the margins for 8,000 Btu/kWh natural gas units were $26.14/MWh. Natural gas units also had less of a profit advantage over coal units in peak month-ahead and peak season Indiana power markets than they had in the first half of December 2024.

Similar economic dynamics are present in the PJM Interconnection and Electric Reliability Council of Texas.

President Donald Trump's full-throated endorsement of the coal sector, his moves to claw back environmental regulations and his administration's efforts to delay coal-plant retirements are boosting producers' confidence about US coal consumption in 2026.

US energy secretary Chris Wright has invoked emergency powers to extend operations at Consumers Energy's JH Campbell plant until at least 17 February 2026. Consumers chief executive officer Garrick Rochow said on 30 October company officials expect the emergency orders for the Campbell plant to continue "for the long term".

Independent of federal action, some utilities also have delayed a handful of power plant retirements and conversions previously scheduled for this year.

All told, about 6,000-6,500MW of US coal capacity is being permanently taken off line or converted to another fuel this year, a sharp reduction from the 9,300MW projected at the very beginning of 2025, information collected by Argus and EIA show. The plant units that have delayed retirement dates consumed 6.7mn short tons (st) (6.1mn metric tonnes) of coal last year and 4.7mn st in the first eight months of 2025, EIA power plant operating data show.

More retirements are scheduled for 2026, but some market participants have expressed uncertainty about their plans for next year, wondering if the Department of Energy (DOE) also will order their facilities to stay open. So far, DOE has directed Consumers' Energy's JH Campbell plant, which was scheduled to retire in May, three 90-day extension orders. And on 17 December, DOE also ordered Canadian utility TransAlta to delay retirement of its coal unit 2 in Centralia, Washington, for at least 90 days. Wright has indicated he could issue further orders.

Some utilities — including CenterPoint, Dominion Energy, Southern Company subsidiary Georgia Power and Santee Cooper — have indicated they may delay coal plant retirements and conversions scheduled for 2026 and later.

Most of the delays are short term and tied to revised timelines for bringing other facilities on line or incremental electricity growth, including potential data center additions. CenterPoint in October cited both economic reasons and greater load growth forecasts for reconsidering converting unit 3 of its FB Culley plant in Indiana to natural gas by the end of next year.

The outlook for US exports is certain. Competition to place coal in European and Asia-Pacific markets remains steady. Those conditions could sustain downward pressure on some US thermal coal export prices and demand.

But producers have expressed some optimism about 2026 US coal markets, with many having filled all of their projected sales book for next year and layered in contracts that have deliveries going out into 2027 and slightly later.

And many market participants are thinking that stabilization might well continue into 2026.