Australia's urea imports in 2026 are likely to maintain the record levels of recent years, as forecasts for favourable weather conditions support strong cropping demand. But low affordability levels among growers could weigh on import demand.

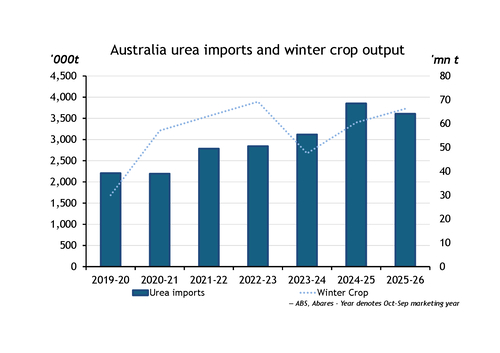

Australia's urea imports are likely to have reached 3.8mn t in 2025, about 5pc below 2024 but 15pc higher than in 2023, according to figures from the Australian Bureau of Statistics (ABS) and vessel tracking data from Kpler.

Australian fertilizer importers told Argus they juggle a range of factors when deciding purchase volumes. Considerations include seasonal conditions, fertilizer affordability and crop outlooks, all of which differ across growing regions.

Fertilizer affordability stays low

Fertilizer affordability will be a key determinant of import demand. Global fertilizer affordability reached a three-year low in July 2025 but has recovered in recent months.

Global nutrient affordability stood at 0.72 points in October, up from 0.69 in September and 0.61 in August, Argus data show.

An affordability index — comprising a fertilizer and crop index — above one indicates that fertilizers are more affordable compared with the base year set in 2004. An index below one indicates lower nutrient affordability.

Australian granular urea was assessed at A$760-770/t fca Geelong on 18 December. Granular urea had reached A$900/t fca Geelong on 4 September, a 21pc increase from A$745/t fca Geelong on 3 January 2025.

Fluctuations in the value of the Australian dollar will act as a buffer or hurdle to fertilizer affordability. The Australian dollar approached a 2025-high of $0.67 to the US dollar at the end of December, which has dampened fertilizer import costs. If the dollar should fall sharply, as happened in April when it dropped to $0.59, this could weigh on fertilizer affordability and temper imports.

Growers' returns from their crops will be weighed down by global oversupply, given near record production levels of key crops such as wheat, feed alternatives and canola from global producers.

The lack of any supply shock, major geopolitical risks and fading demand from major importers — particularly China — have led to subdued prices for wheat, squeezing farmer margins and potential returns from fertilizer applications.

Fertilizer affordability has not eased enough for there to be a spike in demand but has improved enough to support steady imports from previous years.

Average crop, weather forecasts

Urea imports during the October-September marketing year tend to move in step with Australia's crop outlook (see graph). Favourable seasonal conditions and crop development will support fertilizer application to improve yields, and in turn, domestic fertilizer purchases.

If current soil moisture levels are maintained until the autumn months of March-May, this could support crop area intentions and plantings and, in turn, urea imports. But long-term weather outlooks are unreliable and treated with caution by some importers, Argus understands.

Planting conditions and crop allocation could be influenced by seasonal conditions in coming months. Most of Australia's cropping regions have an even chance of exceeding median rainfall in January-March 2026, Bureau of Meteorology (BoM) data show.

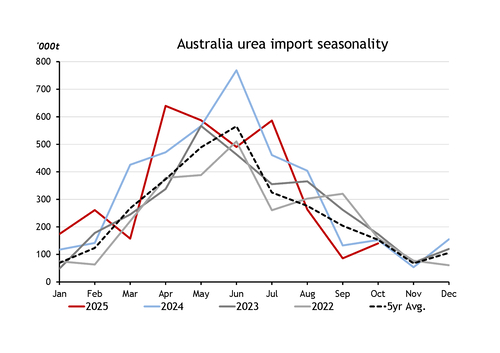

Australia's crop winter crop outlook will partially depend on planting conditions during April-June. Urea application times differ from year to year based on rainfall patterns and the crop type, but most urea is applied from February to July for pre-planting and topdressing (see graph).

South Australia's expected rainfall in January-March is less favourable, showing a less than 45pc chance of exceeding median rainfall in growing regions. Queensland and New South Wales growing regions have a 40-65pc chance of exceeding median rainfall, while Western Australia has a 45-55pc chance, BoM data show.

The weather and soil moisture outlooks similarly suggest steady imports from previous years, but less chance of an increase from 2024 and 2025 levels.