Thailand's LNG demand has been on a downtrend, and sluggish economic growth in the country is expected to further slow consumption and imports.

Thailand imported around 8.6mn t of LNG over January-October 2025, about 11pc lower compared with the same period in 2024, according to Global Trade Tracker data.

A total of 157,976 GWh of electricity usage was recorded over January-September 2025 compared to 163,395 GWh over January-September 2024, according to data from Thailand's Energy Policy and Planning Office (Eppo). Demand was likely limited by the mild weather in the past year, keeping inventories higher than expected and limiting demand for additional gas-fired power generation.

Thailand's gas demand was previously forecasted to rise through the years up to 2030, according to the country's proposed gas management plan for 2024-37.

But demand is now likely to fall as Thailand's GDP growth is expected to narrow to 2.2pc for 2025, and 1.6pc for 2026, down from a record of 2.5pc for 2024, according to a forecast by the Bank of Thailand.

Natural gas consumption in 2024 was recorded at 4.496bn m³/d, up by 2.2pc from a year earlier, according to Eppo. Electricity generation and use for gas in the petrochemical and other industries rose by 6pc and about 7pc respectively, accounting for most of the increase in line with the expanding economy that year, although consumption of natural gas by industrial sector consumption fell by about 13pc following a slowdown in industrial goods production. This slowdown is likely to continue this year, according to market participants.

Spot trends

Thailand's interest for LNG is mostly still driven by gas-fired power generation in the industrial and electricity sectors, which prioritise stability in prices, some traders said.

Thailand has committed to at least another 3.4mn t of LNG through term contracts for deliveries from 2025 onwards, which may signal a decreased appetite for spot requirements because of the limited potential for a growth in power demand. Thai utility Gulf Energy most recently signed a 10-year term agreement to receive up to 800,000 t/yr of LNG from Italy's Eni. With the latest deal between Gulf Energy and Eni, Thailand may receive up to 9.1mn t/yr of LNG through term deliveries in 2027, up from 6.5mn t/yr in 2025, and a projected 8.3mn t/yr in 2026, according to Argus data.

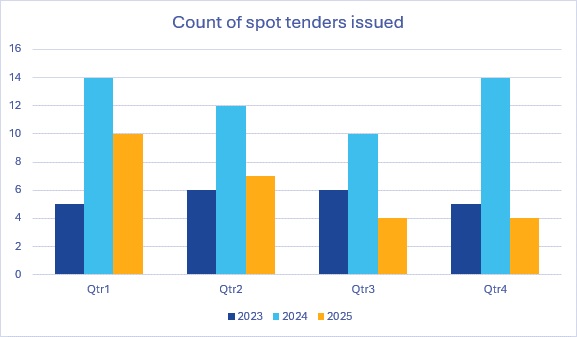

The number of spot tenders issued by Thai importers has dwindled notably, from an average of about 12-13 tenders per quarter over 2024 to just about under seven per quarter in 2025 as of end-November, according to Argus data (see graph). This is despite new entrants in private-sector imports — B Grimm Power, Gulf Energy and Hin Kong Power.

Southeast Asia

LNG demand in the wider southeast Asia region could also be curtailed as a result of gas turbine shortages and increasing production costs. The Philippines and Vietnam plan to boost their gas-fired power capacity, but significant backlogs in the manufacturing of gas turbines could result in delays.

LNG demand in the region may hence be capped, despite the downward trend in spot LNG prices resulting from a new wave of LNG supplies entering the market in 2026 and after. The 14mn t/yr LNG Canada terminal's 7mn t/yr second train, for example, restarted recently, adding more volumes to the Pacific region.

But some demand from Indonesia could surface. Indonesian state-run utility PLN requires 104 cargoes in 2026, while fellow state-controlled gas distributor PGN may need as many as 19 cargoes over the same period, a senior official from the country's energy and mineral resources ministry told Argus.

| Thailand term supply | ||||

| Buyer | Seller | MTPA | Start Year | Duration |

| Gulf Energy | ENI | 0.8 | 2027 | 10 |

| PTT | Cheniere | 1.0 | 2026 | 20 |

| PTT | Oman LNG | 0.8 | 2026 | 9 |

| PTT | Oman | 0.3 | 2025 | 4 |

| PTT | Brunei LNG | Undisclosed | 2025 | 4 |

| Gulf Energy | ENI | 0.5 | 2025 | 2 |

| Hin Kong Power | Gunvor | 0.5 | 2024 | Undisclosed |

| PTT | BP | 1.0 | 2017 | 20 |

| PTT | Petronas | 1.2 | 2017 | 15 |

| PTT | Shell | 1.0 | 2017 | 15 |

| PTT | Qatargas III | 2.0 | 2015 | 19 |

| Argus | ||||