Germany and the Netherlands will need to add substantially more gas to underground storage sites this summer than last to meet their legal filling targets.

Germany and the Netherlands need to inject a combined 226TWh in April-October, in a conservative scenario that assumes withdrawals over the remainder of this winter are in line with the three-year average. This would be up from 185TWh over the period in 2025, which had already been higher than in the previous two years. Germany has a national 70pc target for 1 November, while the Netherlands has a 115TWh target, equating to about 80pc of capacity.

But storage withdrawals may stay high over the remainder of the winter, particularly in the Netherlands. Gasterra plans to fully deplete the 59TWh Norg and 24TWh Grijspkerk sites by 1 April ahead of their handover to operator Nam. The Netherlands' only other large storage site, the 49TWh Bergermeer, held only 15TWh of gas as of 28 January.

Combined German and Dutch withdrawals have held 1.02 TWh/d above the three-year average since the start of January. If withdrawals were above average by half that rate over the remainder of winter — around 510 GWh/d — it would raise injection demand by another 32TWh.

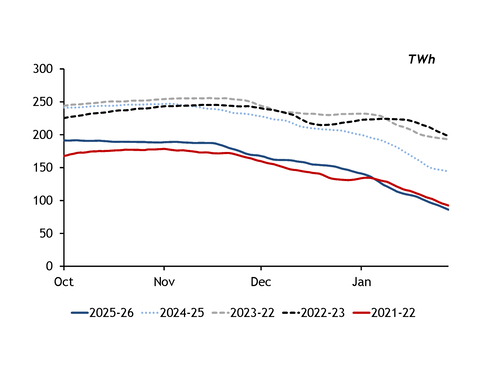

Low stocks in Germany and the Netherlands have an outsized effect on the bloc, as 35pc of the EU's working gas capacity is located in the two countries. German sites were 34pc full on 28 January, the lowest for that date since at least 2011, when GIE data collection began. And Dutch sites were 28pc full, their lowest since 2011, excluding the 2022 crisis year. Stocks in the rest of the EU were at 49pc of capacity.

Market-based filling systems may struggle

Summer restocking faces a major hurdle, because prevailing summer-winter spreads offer no incentive for firms to buy and fill storage space.

The Dutch TTF and German THE summer 2026 contracts have held premiums to corresponding winter 2026-27 prices for almost every day since 16 January. As a result, operators have failed to allocate any of the 5.7TWh of storage capacity offered for the German market area or the 750GWh for the Dutch market area for the 2026-27 storage year at auctions in January.

The German government has so far signalled that it has no plans to intervene to make sure that the country meets its start-of-November filling target. Letting the market handle storage filling is the "right approach" this year, the government told Argus in mid-January. The state last bought gas to fill storage in 2022 during the energy crisis, and recouped the billions of euros that it spent through a levy on consumers that ran until the end of 2025.

Some other European governments have been more interventionist. Italy last year offered bonuses to firms to offset losses from inverted spreads, while French operators received guaranteed minimum revenues, and the Netherlands can mandate storage injections through state-owned EBN when the market fails. In an integrated EU market, such measures can push up summer prices and distort market-based price signals in markets like Germany, where the state safety net is less certain, discouraging commercial filling. German storage operators' association INES has subsequently called for a standardised EU framework.

Consequences for central Europe

Low stocks in northwest Europe are partly driven by the strong west-east configuration of gas flows, and will have implications for central Europe's restocking campaign.

Central European markets have pulled more gas from markets further west, and Germany in particular, since Russian gas transit through Ukraine halted at the end of 2024. German exports to the Czech Republic rose to 251 GWh/d in 2025 from 89 GWh/d in 2024, while deliveries to Austria climbed to 274 GWh/d from 30 GWh/d. German flows to Poland were well under capacity in 2025, but have picked up so far this year because of much lower transport tariffs.

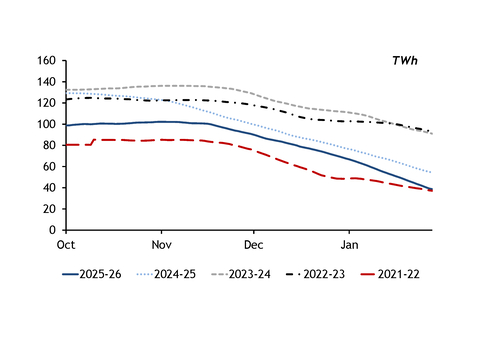

Central and eastern Europe may need to maximise western flows to rebuild stocks ahead of winter 2026-27, especially given that inventories in the region are also below average.