Italian net imports from Switzerland fell to a record low in January as Switzerland faced tight supply and higher generating margins for Italian gas-fired units incentivised more domestic gas burn.

Italy net imported about 860MW from Switzerland last month, falling nearly threefold from the 2.4GW net imported in January 2025.

The Italian January forward contract expired at a €2.60/MWh discount to Switzerland, compared with a €8.50/MWh premium for January last year. And the Italian single national price (Pun) index delivered nearly €0.50/MWh below the Swiss spot over 1-31 January 2026. The north zone delivered less than €0.10/MWh below Switzerland.

Overall Italian net imports fell significantly on the year — down to 4.4GW from 6.6GW in January 2025 — as exports hit their highest since 2020 at 1.1GW and imports were the lowest since 2022 at 5.6GW.

Exports to Switzerland were the highest in three years for any given month in January at 424MW. Exports peaked on average over 11:00-12:00 local time, coinciding with peak Italian wind generation, which averaged 4GW across all hours, nearly doubling on the year.

Milan was hit by a cold spell at the beginning of the month, with overnight lows 4.3°C below seasonal norms on 1-12 January, bottoming out at minus 8.7°C on 8 January. Overall, demand in January averaged 34.1GW, around 1GW above the five-year average.

While demand was up on the year, so was domestic generation, which increased by about 10GW to 30GW — the highest for January since 2022 — as gas burn was around 5GW above the five-year January average at 18GW. Each hour recorded higher gas-fired generation on the year on average in January, with output peaking over 16:00-19:00 local time.

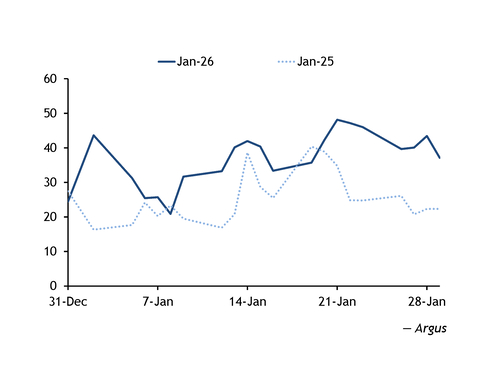

Working day-ahead clean spark spreads for 55pc-efficient units in January averaged €36.74/MWh, compared with €25.41/MWh over the same month last year, as working day-ahead PSV gas averaged over €10/MWh lower on the year — cushioned by expectations of looser global LNG supply — despite increased EU emissions trading system (ETS) allowances.

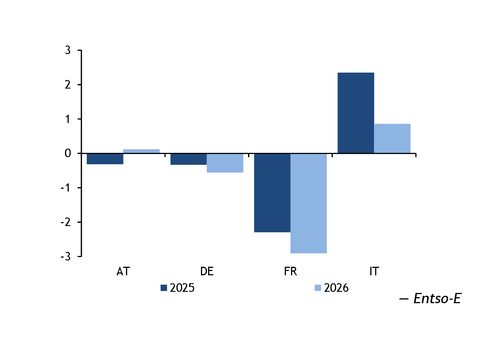

Meanwhile, Swiss nuclear generation was around 1GW lower on the year last month, according to Fraunhofer ISE data, as the 1.02GW Gosgen nuclear plant remained off line in an outage.

And hydro run-of-river and reservoir output were down by 540MW and 140MW, respectively, as rainfall in Sion averaged 1.6 mm/d lower than in January 2025. Although pumped storage output recorded a small 20MW increase — likely on higher demand and to make up for the drop in baseload capacity — hydropower stocks continued to widen their deficit to the long-term average over last month. Swiss load was up by around 330MW, supported by minimum temperatures around 1.6°C lower on the year on average in Zurich.

And Switzerland flipped on the year to net exporting 117MW to Austria last month — after net importing 351MW in January 2025 — due in part to tightness in eastern and central-eastern Europe, with Ukrainian net imports reaching a record January high, as well as a 243MW curtailment at Hungary's 2GW Paks nuclear plant over last month.

But net imports from Germany and France rose by around 225MW and 614MW, respectively, from January 2025.

Gosgen's scheduled return to the grid at the end of February will likely ease tightness in Switzerland, potentially allowing for a better accumulation of hydropower reserves owing to the additional baseload capacity buffer. And minimum temperatures and rainfall in Sion are forecast at a respective 1.6°C and 3.6 mm/d above the norm over 1-20 March, which could provide additional price pressure.

Similarly, minimum temperatures in Milan are forecast to be 1.6°C above seasonal norms for the first three weeks of March, possibly limiting some heating demand. And rainfall in Malpensa is expected to be 1.3 mm/d above averages over the same period, likely contributing to national reserves, which are currently at a large deficit to the norm. Clean spark spreads for 55pc-efficient units for March were last assessed by Argus at €21.65/MWh, slightly up on the year.

But Switzerland's front-quarter discount to Italy has widened by €3.10/MWh over the past month as the latter has made faster gains. While low snowpack at the Donin du Jour and L'Ecreuleuse stations — both below the historical average as of 4 February — currently points to below-average second and third-quarter snowmelt in Switzerland, further decreasing the chance of the country replenishing its hydropower reserves over summer, even weaker hydro conditions later in the year could be expected in Italy.

Italian snow water equivalent has remained consistently below seasonal norms since November, according to meteorological association Cima. Widespread snowfall in late December helped tighten the national deficit to the 2011-24 average to approximately 33pc as of 10 January, from 52pc on 13 December, the latest data show. And snow accumulation at higher elevations, which contributes more to the spring and summer water reserves, has remained well below expectations.