Australian lithium producer PLS has finalised a 150,000 t/yr spodumene offtake deal, which includes a price floor, with Chinese producer Canmax.

PLS will initially supply spodumene to Canmax for two years, but can extend the deal for another year, the company told investors on 10 February.

PLS plans to meet its offtake commitments using output from its Pilgangoora complex in Western Australia (WA), it added.

The company's deal with Canmax values spodumene based on market prices. It includes a price floor of $1000/t on a 6pc lithium oxide-basis (Li2O-basis) but no upper price cap, PLS said.

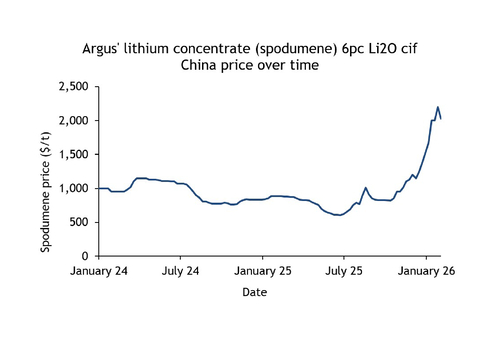

Argus' lithium concentrate (spodumene) 6pc Li2O cif China price was last assessed at $2025/t on 3 February. But the price was assessed below $1000/t at most points during August 2024-November 2025 (see chart).

PLS' deal with Canmax also includes a $100mn, interest-free pre-payment deal. This could support the Australian company's investment plans. PLS will decide whether to restart its dormant 200,000 t/yr Ngungaju processing plant in January-March 2026, it said on 30 January this year. The company may also speed up work on its P2000 lithium expansion project over the quarter.

PLS produced 208,000t of 5.2pc Li2O-graded spodumene in October-December 2025, up by 11pc on the year. It plans to produce 820,000–870,000t of spodumene in the July 2025–June 2026 financial year.

PLS is not the only Australian producer currently working with Canmax. Liontown signed a 150,000 t/yr spodumene offtake deal with the Chinese producer in December 2025. Liontown's deal with Canmax prices spodumene using market indices.