Firm methanol market persists into 2024, partly supported by shipping disruptions

As of late 2023 and into early 2024, shipping disruptions and delays are affecting many commodities, including methanol. Common disruptions include delayed shipping times, increasing freight rates and low vessel availability. Each region is navigating its own unique circumstances based on trade flows and preferred shipping routes. Please note, however, the shipping disruptions are not the sole contributors to tightening supplies as several factors remain at play (Iran winter supply disruptions, delayed startup of new facilities, planned/unplanned outages).

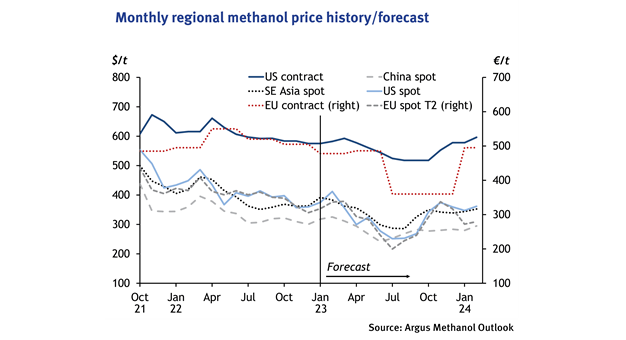

The shipping disruptions have not influenced methanol prices as global supply is ample and demand remains flat. Thus, overall markets have yet to see a real impact from additional freight costs or delays because global supply is enough to meet the current lull in winter demand. However, it is likely sellers are incurring reduced margins due to the additional costs as they are unable to pass them through to buyers.

In North America and South America, shippers typically traverse through the Panama Canal to Asia markets, but with record low water levels through what is usually rainy season (May to December 2023), Panama Canal authorities initially placed a 50pc reduction on the number of vessels allowed to pass through the canal. With the help of water conservation efforts, after November, vessel reduction was scaled back to 33pc below normal levels until at least May 2024.

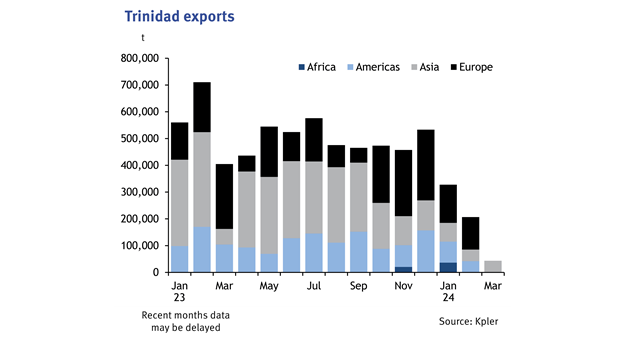

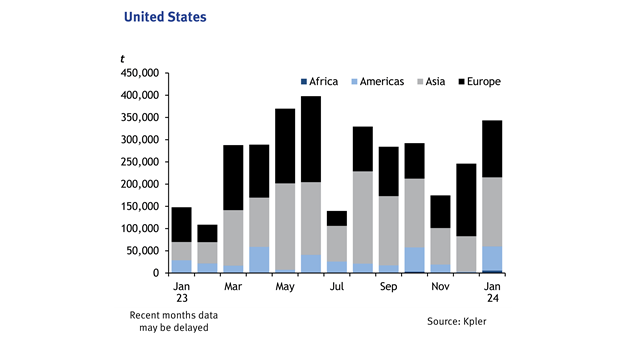

The below charts indicate how these restrictions appear to have affected methanol trade flows for Trinidad and the US, both being major exporters to various regions. Since October 2023, shipping volumes to Asia have dropped from 55pc of export totals (in September) to only 20-25pc in recent months.

Similarly, exports from the US into Asia (which are a small piece of Asia’s imports) decreased in November and December but remained within normal limits before starting to rebound in January 2024. Interestingly, volumes from January 2023 versus January 2024 show an increase of 56pc year-over-year, indicative of increasing efforts to alleviate shipping backlogs from recent months. This could be due to a variety of factors, including US shippers being more aggressive in pre-booking vessels or US producers being more comfortable in absorbing the higher associated costs. Additionally, some shippers may also be traversing alternate routes, including going down and around Cape Horn with an added time of two to three or more weeks to avoid Panama Canal disruptions.

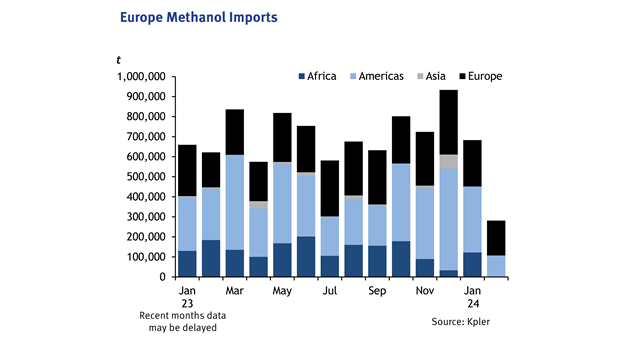

In Europe, similar challenges are faced with cargoes navigating through the Red Sea and Suez Canal. Given the difficulty of Middle East exports moving through these waterways, the Atlantic Basin volumes that were facing disruptions moving into Asia are now quite easily exporting into Europe. In December 2023, there was a 45pc increase from the previous month of Americas exports landing in Europe. At the same time, Middle East producers increased exports into parts of Asia including Malaysia and Singapore. Considering the disruptions, Europe remains comfortably supplied by Atlantic Basin producers, meanwhile Middle East producers can better minimize the run-up in freight costs.

It remains to be seen whether these shifting trade patterns will become a mainstay or simply serve as an alternate option or route pending conditions at the Panama Canal and Suez Canal. If shipping disruptions continue, the new trade patterns may further drive adjustments within the methanol market and may even begin to impact prices.

Author Cassidy Staggers