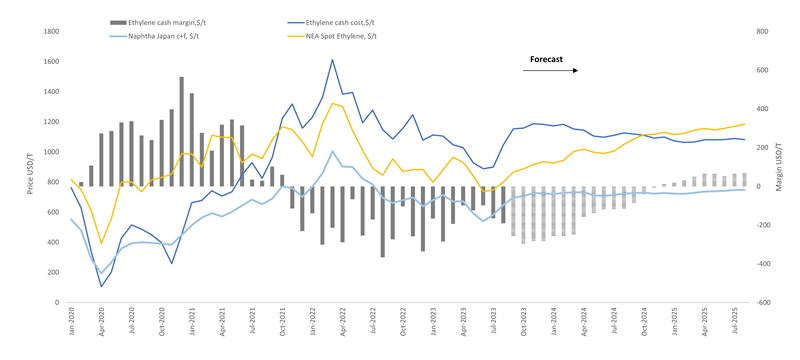

The olefins market in Northeast Asia has been suffering from poor cracker margins over the past two years. As China gradually lifted its pandemic restrictions in late-2022, the world was expecting a recovery to boost the industry. However, the disruption to fundamental balances is lasting longer than expected.

Naphtha cracking margins have turned into a deep negative territory since Q4 2021

The graph shows cracker margins since 2020 in Northeast Asia through Argus’ 24-month forecast. The cash costs and margins for ethylene are estimated based on a generic cracker model (methodology here).

Economic slowdown and disruptions in consumption since the pandemic outbreak have severely impacted naphtha and ethylene dynamics in Northeast Asia. About 7mn t/yr of capacity was added in 2020 and 2021. Supply pressures emerging since 2H 2021 across the region resulted in a further downtrend on the market, in turn eroding cracker margins to negative territory.

The Ukraine conflict and lockdown in China both hit the market in early 2022 along with an abrupt step-up in energy prices. Ethylene cash margins bottomed out at -$335.17 /t in Nov 2022, 160pc lower than 2 years earlier.

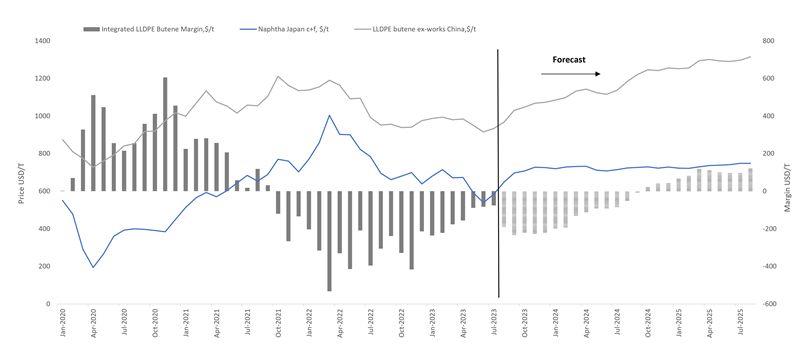

Polyethylene margins suffer

Integrated polyethylene (PE) margins also encountered a huge loss with low PE prices since mid-2021 owing to expanding supply and subdued demand. Geopolitical issues and regional economic contraction further dragged down PE margins to a low point in early 2022. The integrated PE margin bottomed out at around -$500/t in Mar 22, 180 pc lower than 17 months ago. Low PE prices have wiped out PE margins and prompted producers to consider further production cuts and shutting for maintenance, while new capacity is still expanding despite poor margins.

Margins will gradually recover through 2025

Although recent ethylene and polyethylene sentiment bottomed out on the back of strong upstream value and recovering downstream buying interest, rising supply still dampens the outlook through the end of this year. The region’s ethylene capacity growth continues to surpass demand. About 6.95 mn t/yr of new ethylene capacity has started up in this year and a 1.2 mn t/yr mega cracker will be online in this forecasting period. Eight new cracker complexes have been announced this year with a combined 10.75mn t/yr of new capacity in China. About 1.15mn t/yr of new PE capacity is scheduled to start up in late 2023 in China and over 2 mn t/yr capacity would be online through 2025.

Argus projects that naphtha cracker cash margins in Northeast Asia will remain negative through 2024, owing to the increasing cash costs outpacing olefins and coproducts value. However, the steady growth on a macroeconomic basis helps consumption grow and absorb massive supply gradually. Continuous negative margins will force operating rate reduction amongst less competitive crackers and standalone units, and even phase out some units for rationalization to maintain a healthier fundamental balance. Cracker economics are projected to improve and gain profits in early 2025.

It is still questionable how long industry players can operate with continued negative margins and how standalone plants can survive. As household consumer spending rebounds and the property market bottoms out, olefins consumption is still expected to grow steadily through the next two years. That could help drive up demand across the whole region and drive up cracker margins to a more economic level.

This article has been created by Argus’ chemical experts using data and insight from Argus’ Ethylene and Polymers services.

Author Josie Jiang