Nitrogen producers in the US are primed to favor urea output instead of UAN in 2020 on favorable margins as shifting global trade flows are poised to keep pressure on UAN prices.

Urea barge values are anticipated to command a larger margin over production costs than UAN through May 2020, as offshore UAN imports are expected to outstrip demand and keep a lid on price appreciation.

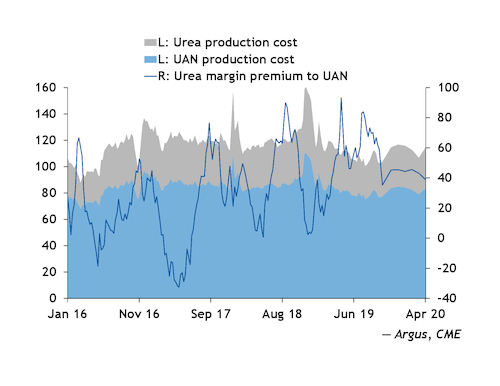

Companies with flexibility to produce both products are estimated to capture about $38-45/st more selling urea at Nola instead of UAN during the next six months based on Argus' production cost estimates and forward contracts as of 4 November.

Forward UAN swaps prices are near parity to current spot physical values around $150/st fob through March, before rising by 6pc into May. Meanwhile, urea futures incrementally climb by 6pcduring the next six months and largely maintain a premium to UAN on a $/unit N basis, making the product attractive to produce.

UAN was last competitive against urea in December 2018 and CF Industries, which can produce more than 50pc of the US' UAN needs, has reduced output by 3pc during the first three quarters of the year in favor of urea, achieving higher sales margins.

If urea price appreciation at Nola materializes in the physical spot market, it would further extend the diversion from production economic trends which began this spring.

Urea barge prices tend to slip in the second quarter, squeezing producer margins and encouraging those with flexible product mixes to manufacture more UAN. But this year bucked that trend as UAN prices at Nola were fairly stable, allowing urea to retain a high premium because of increased foreign availability and weak farmer demand.

Russian and Trinidadian producers escalated imports to the US this year after the EU announced tariffs on UAN imports from the US, Trinidad and Russia. The EU launched its probe in August 2018, and Russian and Trinidad suppliers immediately reduced shipments to Europe and focused on the US market, fueling a 21pc increase in offshore volumes to US ports through August, according to customs data.

Spring demand will be pivotal to tip the domestic UAN market into balance. Sentiment for nitrogen consumption is bullish for spring on estimates for a 93mn-95mn acre corn crop, resulting in nearly 350,000st of additional nitrogen demand compared to 2019, according to Argus estimates.