The foreign policy professionals US president-elect Joe Biden has picked for top positions in his administration have outlined plans for a less muscular, less prominent US role in the Middle East.

Former deputy secretary of state Tony Blinken will be Biden's nominee to lead the State Department, while former State Department policy planning chief Jake Sullivan will become the White House national security adviser when the new administration takes over on 20 January. A Biden foreign policy as outlined by Blinken and Sullivan will focus on Asia-Pacific to meet the rising challenge from China and strengthen US alliances in Europe and the western hemisphere while reducing the US presence in the Middle East.

"Just as a matter of time allocation and budget priorities, I think we would be doing less, not more, in the Middle East," Blinken says. In Sullivan's words, previous Democratic and Republican administrations since the late 1990s have made the mistake of prioritising the military component of the US' Middle East policy at the expense of diplomacy. The policy outlines reflect Biden's views, but they also represent an evolution in the Democratic foreign policy experts' perceptions following four years of antagonistic policy toward Tehran and unconditional support for Riyadh under President Donald Trump. The Biden team is promising a strategic review of relations with Riyadh while planning to de-escalate tensions with Tehran by returning the US to the Iran nuclear deal.

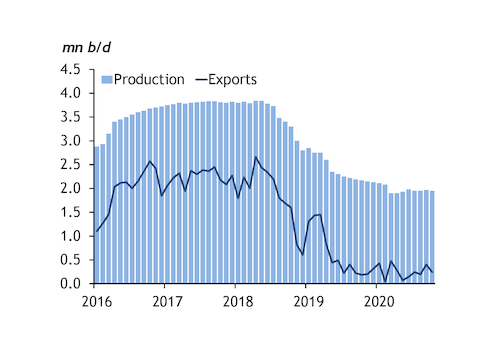

Both Blinken and Sullivan have argued that the US ought to rejoin the Joint Comprehensive Plan of Action (JCPOA) nuclear deal, including oil sanctions relief, so long as Tehran resumes compliance. The approach rejects arguments by some Democratic experts and Trump officials that the new administration should use new leverage gained as a result of sanctions introduced since 2018. The latest round of sanctions has cut off more than 2mn b/d of Iranian crude exports.

Blinken lights

The planned reset in the US' foreign priorities is causing concern in regional capitals that backed Trump's maximalist policy toward Tehran. "We believe that the issue is not just with the nuclear programme — it is with the regime in Iran and the fact that it continues to believe in imposing its will on the region," Saudi foreign minister Prince Faisal bin Farhan says.

Riyadh is calling for what it terms "JCPOA++" — holding broad talks with Tehran to address its nuclear programme at the same time as imposing constraints on Iran's missile programme and regional activities. But Sullivan says tying the nuclear file to Tehran's detente with its neighbours is counter-productive "because it is possible that the latter does not go anywhere". Tehran and its regional rivals should negotiate directly, even though the US can facilitate such talks by promising long-term sanctions relief for Iran, he says.

Previous attempts by Biden's predecessors to reduce the US' footprint in the Middle East fell short — in Trump's case, because of his aggressive tactics towards Tehran, and for former president Barack Obama, because of the rise of Islamist group Isis and the Syrian civil war. The incoming Biden team will have to contend with a determination by the outgoing administration to sabotage his Iran policy, including by encouraging Israel and Saudi Arabia to challenge the new approach.

The Middle East, as a result, is likely to demand more urgent attention from the new US government than it thinks it warrants, competing as it will with other administration priorities, such as relations with China and a return to the Paris climate accord. Biden has picked former secretary of state John Kerry, who presided over the JCPOA talks, to lead the US climate change effort.