Agricultural and sea products agency FranceAgriMer's latest balance sheet echoes a newfound competitivity for French wheat as the origin's underlying futures contract slides while rival Russian wheat prices find a $300/t fob floor.

In its January report, FranceAgriMer pegs French wheat exports to non-EU countries at 10.6mnt in 2022-23, up by 300,000t from the previous estimate.

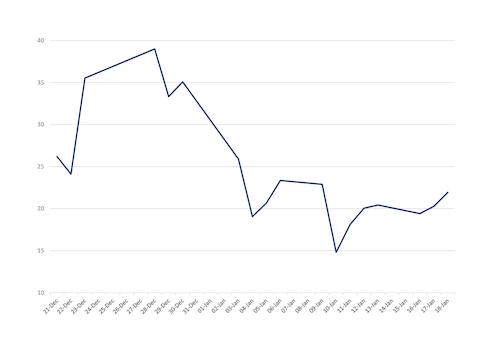

Market sentiment supports the upward revision. French sales have been slow to traditional destinations — with the exception of China and Morocco — ever since the first two months of the marketing year, after which more competitive Russian and Ukrainian sellers returned to the market. But a mostly downward trend in Paris-listed milling wheat futures prices over the past two weeks has allowed French wheat and its freight advantage to north Africa to once again compete with Russian origin. The discount of Russian wheat to French product has been below $25/t since the start of 2023, Argus-assessedUS dollar denominated fob prices at Rouen and Novorossiysk show, with the spread falling to as low as $15/t on 10 January (see chart).

Exporters continue to line up wheat cargoes at all three of France's main export ports. Shipments to China and Morocco dominated in the final months of 2023 — China is logistically unable to source large volumes from Russia, while the Moroccan government has tweaked mills' import subsidies to incentivise purchases of European wheat this marketing year.

But in the past three weeks, interest in French wheat for other destinations has returned to the fore; successful participants under OAIC's latest optional-origin tender are in the market for February-March shipment, while suppliers that agreed volumes under the buyer's previous February shipment tender are still seeking part of the volumes needed to load.

That said, any fresh French export sales are now likely to be supplied from Rouen and Dunkirk. In contrast to these northern ports, France's southwestern Panamax port at La Pallice is trading at a much higher premium to Euronext futures. La Pallice is drawing sellers from neighbouring regions as a result, with truckloads of wheat with a higher test weight from areas such as Brittany sent at high transport costs to supplement the lower test weight of southwestern crop. But market participants still expect supply to the port to sell out by the end of March, with cpt buyers only seeking small, final volumes for fob cargoes already sold.

FranceAgriMer's upward revision to non-EU exports more than compensates for slightly lower projected exports within the bloc. The agency trimmed its earlier forecast of 6.73mn t of French wheat shipments to the EU 27 in 2022-23 to 6.64mn t in its latest report. European buyers have cut demand across feed grains this marketing year, but have also received significant volumes of Ukrainian wheat at far more competitive prices.

France, alongside the world's other top eight exporters excluding Russia, is due to finish the marketing year with lower stocks, leaving little room to accommodate unfavourable weather for the upcoming 2023 crop. Under its January projections, FranceAgriMer expects France to end the 2022-23 campaign in June with 2.33mn t of soft wheat in stock, down from its previous estimate of 2.55mn t.