Ethanol producers concerned about their place in California's Low-Carbon Fuel Standard (LCFS) may take some comfort from changes under consideration at both the state and federal levels.

The California Air Resources Board (ARB) will adopt a series of amendments to the LCFS before the end of the year that some biofuel producers say tilts the field in favor of electric vehicles. But they may find a silver lining in some of the new opportunities state and federal policy could provide the industry.

One of the main concerns is a provision that would allow generators of LCFS credits from electricity to indirectly claim renewable power as a source, thereby lowering the carbon intensity of the fuel and increasing its value in the program. This could undermine the program's technology-neutral design, according to Renewable Fuels Association (RFA) president Bob Dinneen.

"Biofuel producers are not allowed to claim similar credit, even if the producer is able to present documentation verifying the purchase of biogas or renewable electricity," Dinneen said.

The ARB board likely will vote on the LCFS revisions in September. Those changes would require a 20pc reduction in the carbon intensity of transportation fuels by 2030, rather than the 10pc by 2020 under the existing regulation.

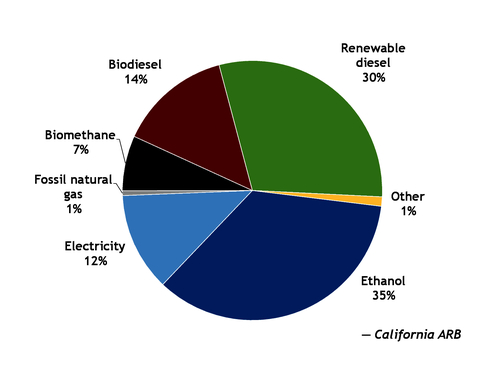

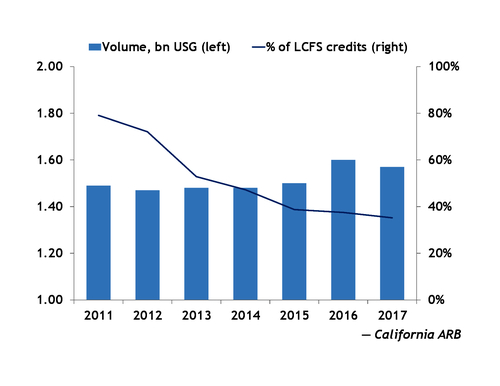

Ethanol remained the leading fuel in terms of credit generation last year, accounting for 35pc, but that number has dropped from nearly 80pc when the program started in 2011. The agency is projecting a decline in credits from cellulosic, sugar and starch ethanols, while credits from electricity steadily climb, in order for the state to meet the new target.

The state also has started to invest heavily in charging infrastructure to support a goal set by governor Jerry Brown (D) of 5mn zero-emission vehicles on the road by 2030. No similarly lofty goal exists for flex-fuel vehicles.

But the updated LCFS may also provide the industry with new opportunities.

The ARB plans to allow projects that capture CO2 and inject it into underground geologic formations to generate LCFS credits. A team of Stanford University researchers found that ethanol biorefineries could emerge as the primary beneficiary of such a move by taking advantage of favorable economics.

The average corn ethanol carbon intensity drops from 70g CO2e/megajoule to 40g CO2 with the use of carbon capture and sequestration, according to the ARB, which would earn producers more LCFS credits.

The industry may also get help from President Donald Trump, who appears intent on altering the federal Renewable Fuel Standard (RFS) in ways that could lead to more ethanol use in California.

A group of US senators emerged yesterday from a meeting with Trump and said he agreed to direct the US Environmental Protection Agency (EPA) to allow sales of gasoline with up to 15pc ethanol (E15) year-round.

The higher blend is normally prohibited during the summer months due to air pollution concerns.

Brooke Coleman, executive director of the Advanced Biofuels Business Council, said she was "encouraged that the White House has told EPA administrator [Scott] Pruitt to get to work immediately on a long-overdue fix to summer regulations that limit sales of E15."

California precludes the sale of E15, which is sold in 30 other states. The state limits ethanol to a 10pc blend, but ethanol groups are pushing to amend the regulation.

The ARB said it was "monitoring federal actions" and conducting tests but did not provide a timeline for further action.

Use of the fuel in California could cut greenhouse gas emissions by an additional 15mn-19mn t by 2030, the RFA estimates. That figure should appeal to state regulators who want to ensure that the LCFS plays a central role in reaching the state's climate goals.