Limited prompt rapeseed supply and rising demand for rapeseed oil (RSO) from the EU biodiesel sector will continue to support higher European prices in the first half of next year.

The shortfall of RSO feedstock in Europe could last until the beginning of the new 2022-23 crop year in July, because of severe delays in canola shipments from Australia and lower import levels from Canada, two major rapeseed supplier to the EU.

Australian canola, which is a variety of rapeseed, typically arrives in Europe from December when EU domestic rapeseed supply becomes seasonally scarcer. But Australia's shipping programme is almost already fully committed for the next couple of months, according to participants, with canola competing with grains for available containers.

Australian canola production is forecast to hit 5.7mn t in the 2021-22 season — a record high — of which around 4.3mn t could be available for export, according to Dutch bank Rabobank's latest projections. But the country's wheat harvest for 2021-22 will also hit a record, lifting Australia's overall available exports, and tightening shipping capacity further for the first half of 2022.

In Canada, the largest producer of canola globally, 2021-22 canola production has declined by around 25pc year on year because of drought conditions. EU imports of Canadian canola dropped to around 100,000t in the July-November period from around 1mn t a year earlier, EU data show.

The rapeseed supply tightness in Europe has caused prices to soar in recent weeks, creating a steep backwardation between old crop and new crop forward contracts. The Euronext rapeseed February 2022 contract hit an all-time high of €718.25/t ($809/t) on 10 December, while the August 2022 contract traded around €170/t below the February contract in December.

With oilseed crushers' rapeseed stocks almost depleted, some producers expect to be forced to reduce or even halt RSO production at the beginning of 2022. At the same time, high rapeseed prices paired with raised production costs caused by high energy prices have deteriorated crush margins for prompt RSO and the February-March-April (FMA) 2022 strip, putting a damper on RSO production appetite.

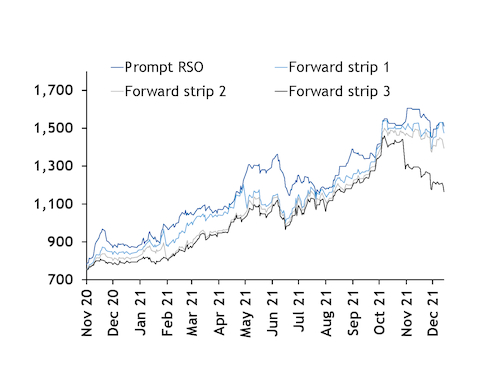

Just like its feedstock, the fob Dutch mill RSO forward market structure is comparably flat until the beginning of the new 2022-23 marketing year, with new crop RSO positions deeply backwardated to old crop contracts (see graph). The August-September-October (ASO) 2022 RSO contract traded an average €292/t below the FMA strip's average of €1,480/t ($1,666/t) in the 1-14 December period.

Demand for RSO — particularly from the biodiesel and hydrotreated vegetable oil (HVO) sectors — is likely to be strong in 2022, as more key EU biofuel markets introduce a ban or cap on alternative vegetable oils palm and soybean oil in biodiesel production next year as part of their implementation of the recast of the Renewable Energy Directive (RED II).

The Netherlands and Belgium will ban palm oil in biofuel production from 2022, with the latter also excluding soybean oil from the process. Key market Germany will cap the use of palm oil at 0.9pc in 2022 and ban the feedstock in 2023. Austria excluded palm-oil based biofuels from its domestic blending scheme in mid-2021, and France has had a palm-oil ban in place since the beginning of 2020 and will cap the use of soybean oil at 0.35pc in 2022.

The palm-oil phase out in major European biofuel markets is likely to have a knock-on effect on EU countries that do not have a ban in place, with the number of outlets still available to take in palm oil-based biodiesel and HVO shrinking.

As a result, European RSO prices, which typically follow the pattern of Malaysian palm oil and Chicago-listed soybean oil futures, should become less sensitive to price movements in the wider vegetable oil complex from 2022.