Demand for biofuels for bunkering in northwest Europe could remain steady near current price levels in 2024, even with the EU set to begin charging shipowners for 40pc of their CO2 emissions.

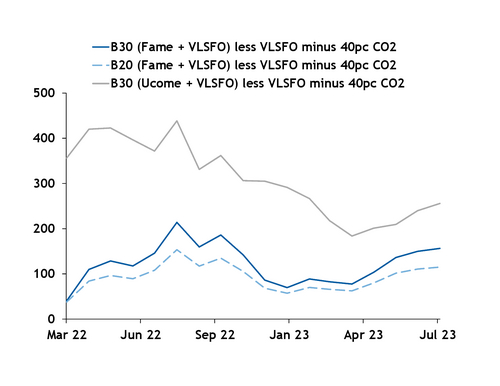

Ships traveling in EU territorial waters will have to pay for 40pc of their CO2-equivalent emissions beginning in 2024. Prices of biofuels for bunkering remain at a premium to conventional marine fuel — very low-sulphur fuel oil (VLSFO) — even with the added cost of CO2. B30, a blend of advanced fatty acid methyl ester (Fame) and VLSFO, and B30, a blend of used cooking oil methyl esters (Ucome) and VLSFO, were pegged at $191/t and $291/t, respectively, premiums to the VLSFO average in August, Argus data showed. EU-traded CO2 averaged at $92.5/t. With the added 40pc emissions CO2 cost, the premium was pegged at $156/t for advanced Fame B30 blend and at $256/t for Ucome B30 blend (see chart).

Container shipping companies — including Maersk, Hapag-Lloyd, Ocean Network Express, CMA-CGM, Matson and Evergreen — have pledged net zero emissions by 2050. They have been actively exploring the use of biofuels and passing the extra cost to their customers in the form of higher freight rates. Their customers represent some of the largest retailers in the world, including Amazon, Ikea, Michelin, Patagonia, and Unilever, among others. But the number of container ship companies' customers able and willing to pay more for cleaner freight might have peaked.

Beyond container shipping companies, bulk carriers and tanker owners are unlikely to embrace biofuels for bunkering on a larger scale just yet. Their customers and shareholders are not as environmentally driven.

Biofuel blends for sale as marine fuel accounted for 6.9pc of Rotterdam's marine fuel demand in the second quarter of 2023, port of Rotterdam data showed. Their share of Rotterdam bunker demand has ranged from 2.0-9.3pc from the first quarter of 2021 to the first quarter of 2023. In 2024, their share of demand might not surpass 10pc, if northwest Europe Fame and Ucome prices remain steady or increase relative to VLSFO.

Another factor that could keep biofuels for bunker demand steady are Netherlands biotickets for advanced Fame for bunkering. The tickets, issued by the Dutch government, shave off about 40-60pc of the outright price of advanced Fame.

The use of Netherlands biotickets for bunkering are revisited by the government every year. Next year, the government could reduce the number of biotickets for bunkering or scrap them altogether.