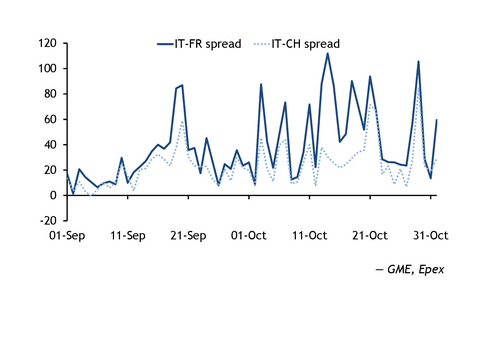

The Italian single national wholesale power price (Pun) increased its premium to France and Switzerland in October, although November expiry prices suggest spreads could tighten again this month.

The Pun averaged €134.27/MWh in October, €15.27/MWh above October's expiry in the over-the-counter (OTC) market and €18.57/MWh above the September day-ahead average. It delivered at a €49.92/MWh premium to the French Epex spot, €23/MWh higher than in September, after Italy October had expired at a €27.85/MWh OTC premium to France.

The Pun's premium to the Swiss spot rose to €28.71/MWh last month, up from €18.72/MWh in September and above Italy October's €17.90/MWh OTC premium to Switzerland at expiry (see chart).

Lower nuclear unavailability in France weighed on French spot prices. Unavailability totalled 20.7GW in October compared with 21.7GW a month earlier, combining with a 2GW increase in wind output to depress French prices. And in Switzerland, higher nuclear output and lower demand pressured the Swiss Epex spot. Swiss power demand in October declined by 800MW to 6.2GW, the lowest since July 2022.

Scheduled net imports from France and Switzerland — Italy's two largest power exporters — rose by 600MW and 500MW on the month, respectively, to the highest since July at 2.4GW and 3GW. The increase occurred despite lower Italian demand, which declined by 1.4GW to 31.1GW in October owing to mild temperatures in Rome and Milan, weighing on cooling demand.

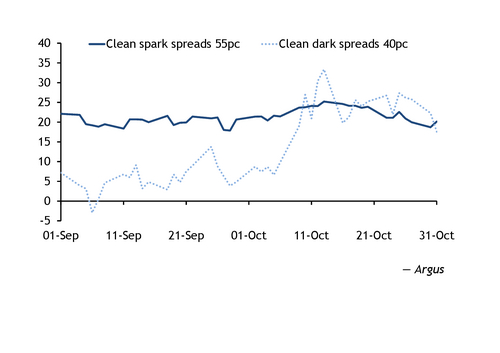

Operating margins for Italian gas-fired plants rose by 22pc on the month, with day-ahead clean spark spreads for 55pc efficiency increasing to €26.81/MWh in October from €20.87/MWh in September. The PSV day-ahead gas contract increased by €5.77/MWh to a €44.09/MWh average, while EU emissions trading scheme spot allowances averaged €80.93/t of CO2 equivalent (CO2e), down by almost €1.10/t of CO2e on the month.

But gas-fired generation declined in October, by 400MW on the month to 11.5GW, owing to higher wind output and more competitive imports into the north zone. Wind generation rose by 200MW to the highest since May at 2.5GW.

The Pun delivered at €131.09/MWh in week 43, down by €18.14/MWh from the previous week and the lowest weekly average since the last week of September. The premium to the equivalent French and Swiss spots narrowed on the week, falling by €24.55/MWh and €13.43/MWh to €41.73/MWh and €27.05/MWh, respectively. And the north zone premiums to France and Switzerland closed slightly lower at €40.38/MWh and €25.71/MWh, respectively.

French power remains competitive

Imports from France may continue to be attractive this month on expectations of more expensive gas-fired generation.

Italy's November OTC premium to France increased from €16.70/MWh at the start of the month to expire at €34.25/MWh, although below an all-time high of €39.10/MWh on 27 October. French nuclear unavailability is scheduled at 13.7GW in November, well below 20.7GW in October and the lowest since January 2022.

Improved French nuclear unavailability may lift exports to Italy and reduce the need for more expensive Italian thermal generation. Italian front-month clean spark spreads for 55pc efficiency ended October at €20.14/MWh, down from €21.39/MWh at the start of the month and below a monthly high of €25.22/MWh on 13 October.

November spark spreads closed below levels at the beginning of the month, but sharp losses on the November PSV gas product on 31 October's session outpaced those on cif ARA coal swaps, flipping clean spark spreads for 55pc efficiency to an advantage to clean dark spreads for 40pc-efficient units for the first time in nine sessions at €2.60/MWh (see chart).